In July 2024, Amazon and Walmart saw significant shifts in advertising dynamics driven by major sales events. Amazon’s Prime Day, held in the third week of July, led to increased ad spend, CPC, and competition as sellers aimed to capitalize on the surge in consumer interest. Concurrently, Walmart ran its promotional deals in the second week of July, intensifying the competition and attracting shoppers with alternative savings.

This analysis highlights the impact of these events on ad spend, CPC, and RoAS for Amazon and Walmart in July 2024. We’ll examine how sellers adapted their strategies during this critical period, comparing trends from the previous year and the shifts from June to July. The data reveals key insights into the competitive landscape during one of the year’s most important shopping periods.

July 2023 vs. July 2024

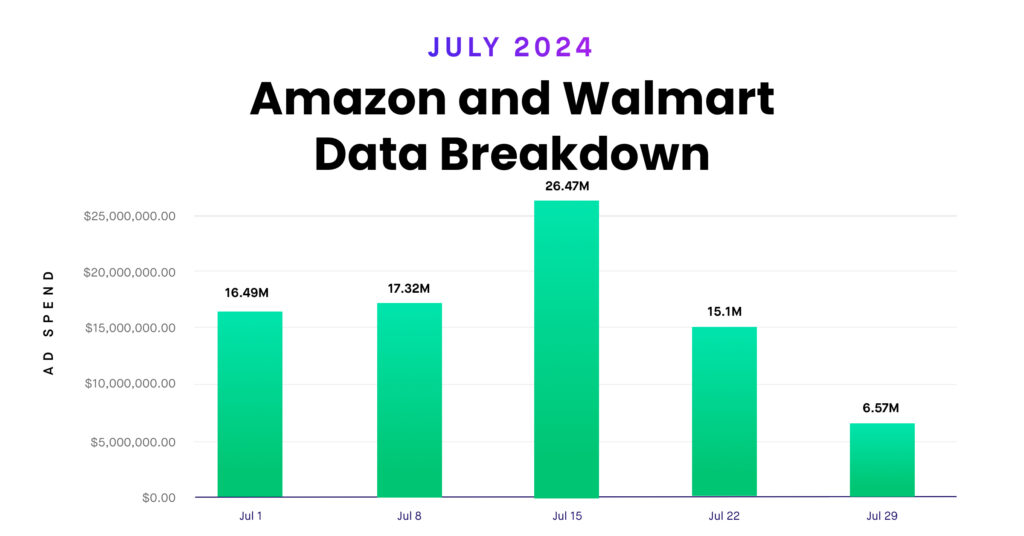

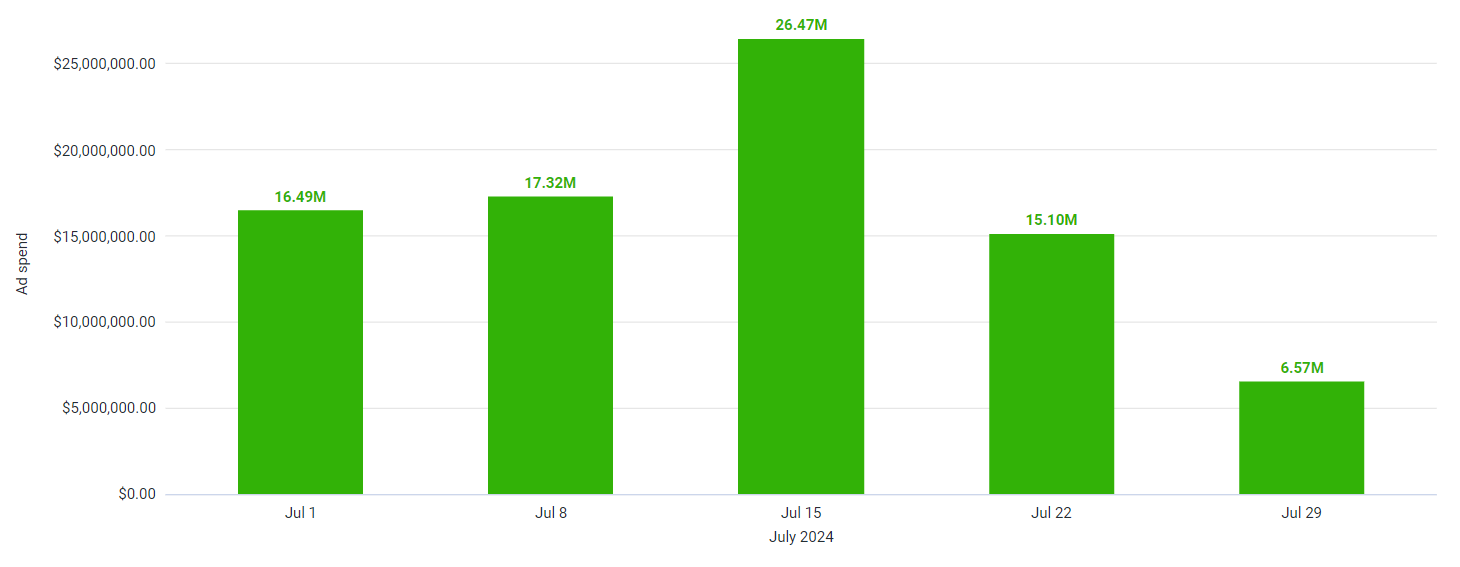

In July 2024, the total ad spend reached approximately $81.95M, compared to around $57.85M in July 2023. This marks a significant increase of about 41.7%. The rise in ad spend highlights the intensified competition and more significant seller investment on both Amazon and Walmart during this key shopping period.

Several factors likely contributed to the substantial increase in ad spend during July 2024:

1. Prime Day and Walmart Deals: The timing of Amazon’s Prime Day in the third week of July and Walmart’s competing promotional events earlier in the month likely drove a surge in advertising investment as sellers aimed to capitalize on the heightened consumer interest.

2. Competitive Market Dynamics: With both Amazon and Walmart intensifying their promotional efforts, sellers were compelled to increase their ad budgets to maintain visibility and competitiveness in a crowded marketplace.

3. Shift in Consumer Spending Patterns: The continued shift towards online shopping, especially during major sales events, likely encouraged retailers to allocate more resources to digital advertising to capture the attention of a growing online customer base.

June 2024 vs. July 2024

When analyzing the ad spend data from June 2024 compared to July 2024, we observe a notable increase in July. The total ad spend for June 2024 was approximately $72.58M; in July 2024, it surged to about $81.95M. This represents a significant increase of around 12.9% in ad spend.

A combination of factors most likely caused this surge. As retailers targeted summer shopping trends, July may have seen significant promotional events and mid-year sales, resulting in increased ad budgets. Additionally, improved ad strategies and more efficient campaigns could have resulted in increased investment. Retailers also adjusted their spending based on performance data from May and June, hoping to capitalize on emerging opportunities. For sellers, this emphasizes the importance of adapting strategies to capitalize on seasonal trends and effectively allocate budgets.

Ad Spend, CPC, and RoAS Insights for Amazon and Walmart

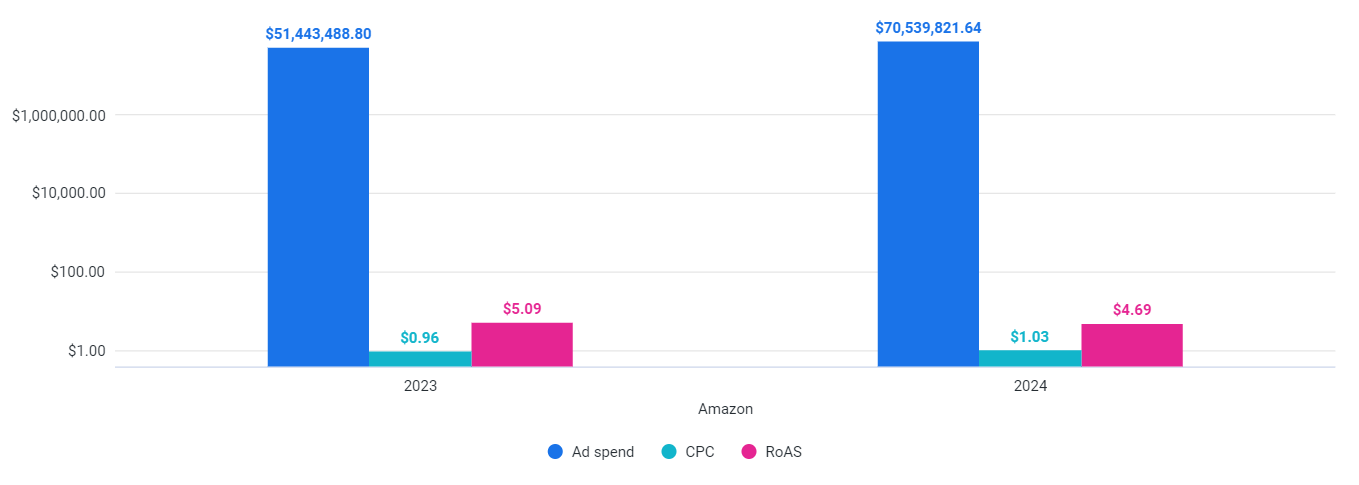

Amazon – 2023 vs 2024

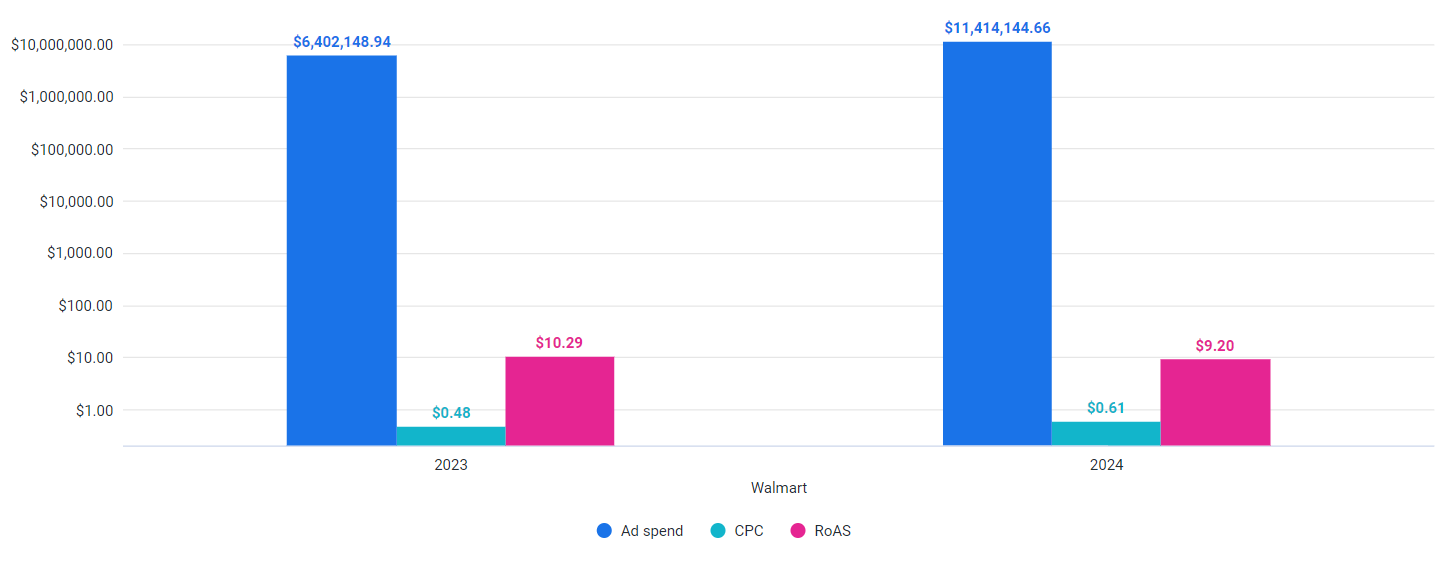

Walmart – 2023 vs 2024

CPC (Cost Per Click):

In 2024, Amazon’s CPC increased to $1.03 from $0.96 in 2023, marking a rise of approximately 7.3%. This upward trend in CPC reflects the competitive nature of Amazon’s advertising landscape, which is driving up the costs of clicks. Walmart also experienced a rise in CPC, increasing from $0.48 in 2023 to $0.61 in 2024, representing a 27.1% increase. This significant rise in Walmart’s CPC underscores the growing competition and higher cost of advertising on the platform.

Ad Spend:

Sellers significantly adjusted their ad spend in 2024 compared to 2023. Amazon sellers’ ad spend surged to $70.54M in 2024, up from $51.44M in 2023, marking a 37.0% increase. This substantial rise highlights Amazon sellers’ increased investment in advertising to capture a larger market share. Walmart sellers also increased their ad spend, growing from $6.40M in 2023 to $11.41M in 2024, representing a 78.3% increase. The substantial boost in Walmart’s ad spend reflects a growing emphasis on capturing consumer attention and competing effectively in the market.

RoAS (Return on Advertising Spend):

Amazon’s RoAS decreased from $5.09 in 2023 to $4.69 in 2024, a 7.8% drop. This decline is primarily due to the increased CPC, which raised the cost of acquiring clicks without a proportional rise in sales revenue. Despite a substantial increase in ad spend, from $51.44M to $70.54M, the revenue generated per advertising dollar needed to catch up, leading to lower returns. Additionally, market saturation and increased competition have reduced the effectiveness of each ad dollar spent, contributing to the decline in RoAS.

Walmart’s RoAS also fell from $10.29 in 2023 to $9.20 in 2024, a 10.6% decrease. This drop is attributed to higher CPCs and increased ad spend not translating into proportional sales growth. Both platforms are experiencing diminishing returns due to competitive pressures and market saturation, emphasizing the need for optimized ad strategies to improve efficiency and return on investment.

In summary, the ad spend analysis for July 2024 reveals a substantial increase compared to the previous year, reflecting a stronger commitment to advertising and potentially better market conditions. Due to the promotional events and Prime Day, ad spend in July was significantly higher than in June. This increase highlights ongoing investment in capturing consumer attention and leveraging significant sales events to drive advertising efforts.

Ready to make this data actionable? Teikametrics’ industry-leading AI can help you achieve your goals with access to near real-time data and hourly optimization. Experience the game-changing difference with a free demo webinar.