As we delve into the ad spend analysis for June 2024, we notice some interesting trends and insights, particularly for major retailers like Amazon and Walmart. This analysis compares ad spend, CPC, and ACOS for Amazon and Walmart in June 2024 to the previous year and examines the shifts from May to June 2024. This month, we’ll look at the key advertising metrics that provide insight into the strategies used by sellers on both retailers’ marketplaces.

June 2023 vs. June 2024

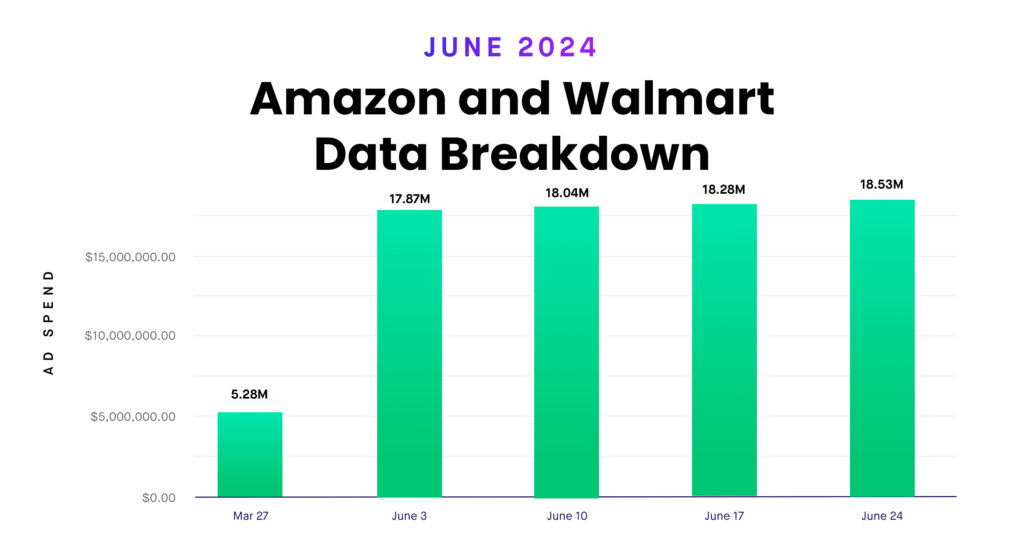

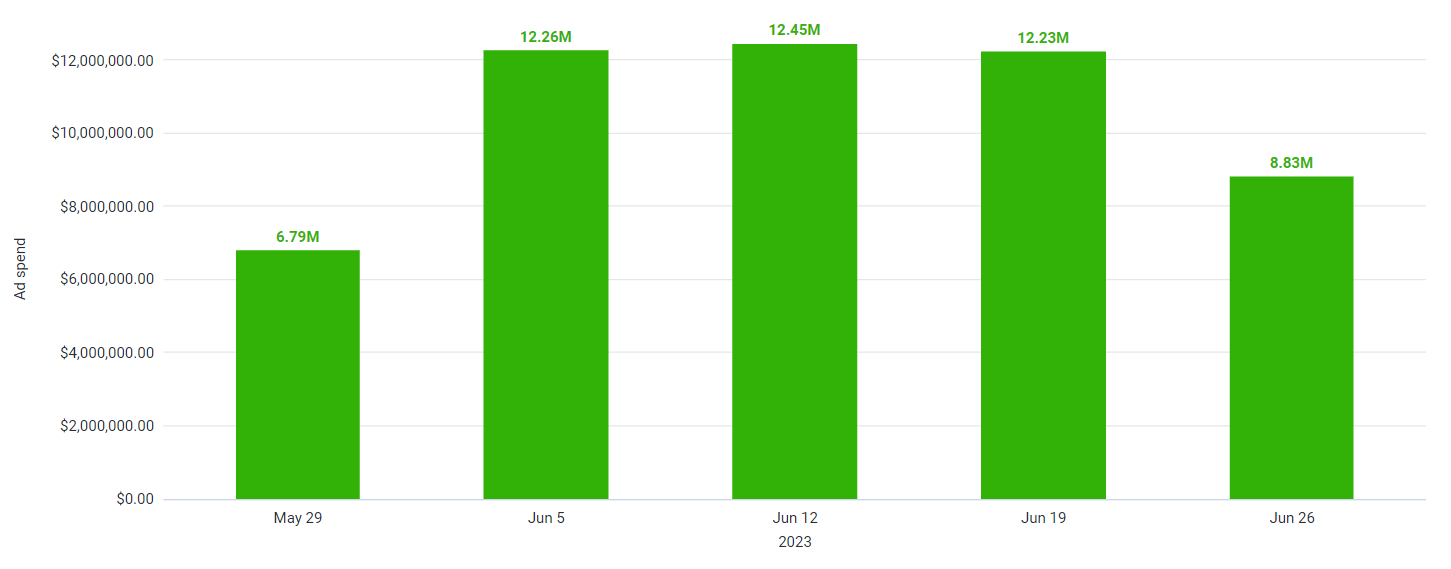

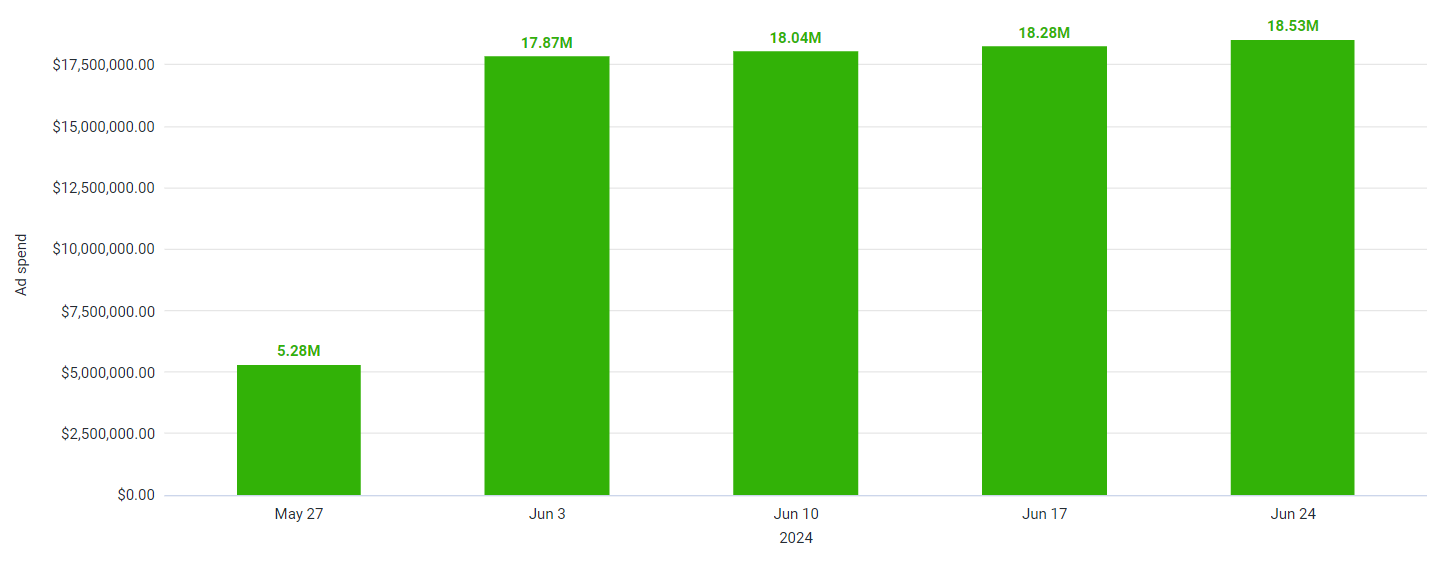

Ad spend significantly increased from June 2024 to June 2023. The total ad spend for June 2024 was approximately $77.99M, whereas for June 2023, it was around $52.55M. This represents a substantial increase of about 48.4%.

Several factors could have contributed to this increase:

1. Improved Advertising Strategies: Retailers may have invested more in advanced advertising technologies and platforms to target their customers better.

2. Economic Conditions: An improving economy may have increased consumer spending, encouraging retailers to increase their advertising budgets.

3. Customer Behavior: Increasing online shopping trends and higher engagement rates on e-commerce platforms may have resulted in increased ad spending.

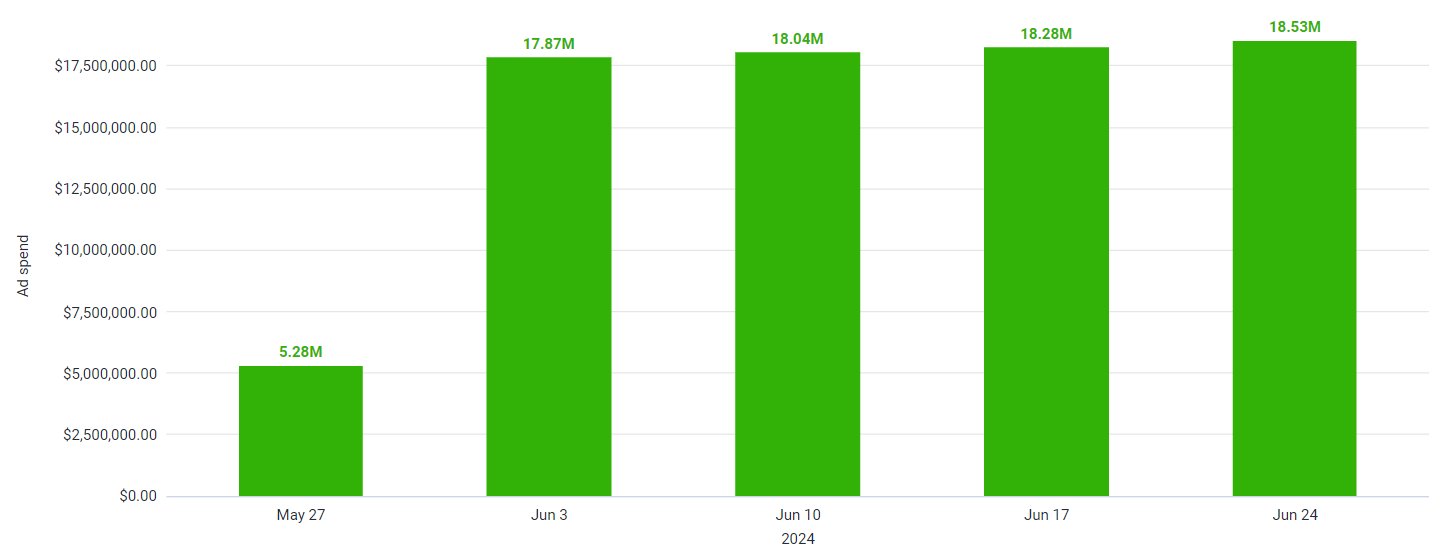

May 2024 vs. June 2024

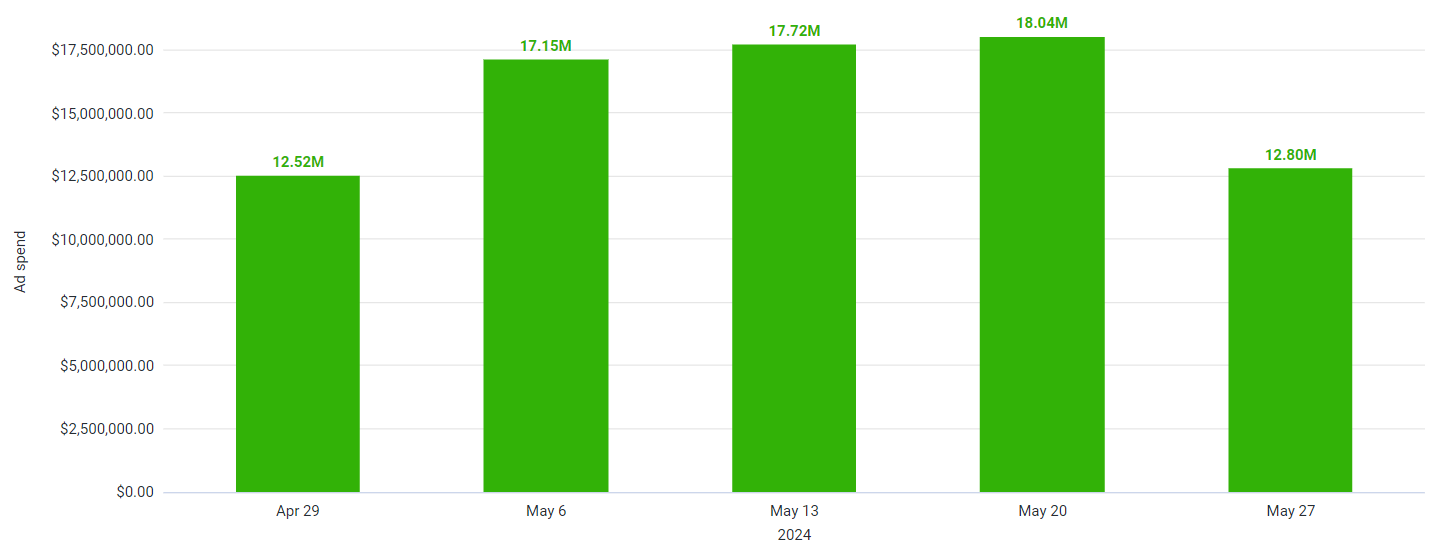

When comparing May 2024 to June 2024, we observe a slight decrease in total ad spend. In May 2024, the total ad spend was about $78.23M, while in June 2024, it slightly decreased to $77.99M, reflecting a minor decrease of approximately 0.3%.

Potential factors contributing to this slight drop could include:

1. Seasonality: May could have included promotional events or end-of-quarter sales requiring higher ad budgets, while June might have seen a normalization of spending.

2. Ad Spend Optimization: Retailers may have optimized their ad spending, focusing on using their budgets more efficiently.

3. Market Adjustments in marketing strategies based on the performance and insights from the previous month might have led to a more strategic allocation of resources.

Amazon and Walmart- Ad spend, CPC and ACOS

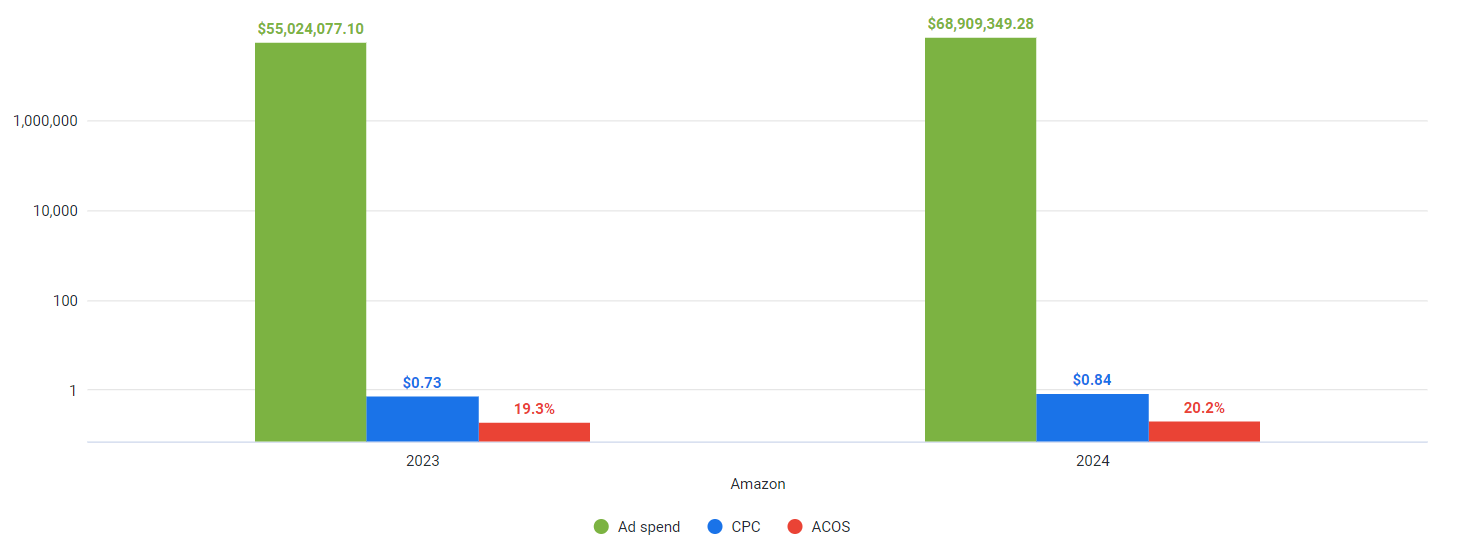

Amazon – 2023 vs 2024

Walmart – 2023 vs 2024

Analyzing Ad Spend Trends: June 2024

CPC (Cost Per Click):

Amazon and Walmart Connect demonstrated consistent CPC rates in the dynamic online advertising landscape. In 2024, Amazon’s CPC increased to $0.84 from $0.73 in 2023, reflecting a significant rise of approximately 15.1% in advertising costs. Similarly, Walmart Connect experienced an increase in CPC, rising from $0.52 in 2023 to $0.59 in 2024, indicating a 13.5% increase.

ACOS (Advertising Cost of Sales):

Examining the Advertising Cost of Sales (ACOS), Amazon’s ACOS increased slightly from 19.3% in 2023 to 20.2% in 2024, representing a 4.7% rise. Meanwhile, Walmart Connect’s ACOS rose from 10.1% in 2023 to 10.6% in 2024, representing a 5.0% increase.

Ad Spend:

Sellers worked on bringing up significant changes in 2024 compared to 2023 regarding ad spend allocation, as revealed by Amazon and Walmart Connect. The ad spend of Amazon sellers increased by 25.19%, from $55.02M in 2023 to $68.91M in 2024. Conversely, Walmart Connect sellers saw a significant increase in ad spend, from $8.72M in 2023 to $10.38M in 2024, a 19.01% increase.

In summary, the ad spend analysis for June 2024 reveals a notable year-over-year increase, indicating more substantial advertising efforts and possibly improved economic conditions and customer behaviors. However, the slight month-over-month decline from May to June suggests strategic budget adjustments and the impact of seasonality. Ready to make this data actionable? Teikametrics’ industry-leading AI can help you achieve your goals with access to near real-time data and hourly optimization. Experience the game-changing difference with a free demo webinar.