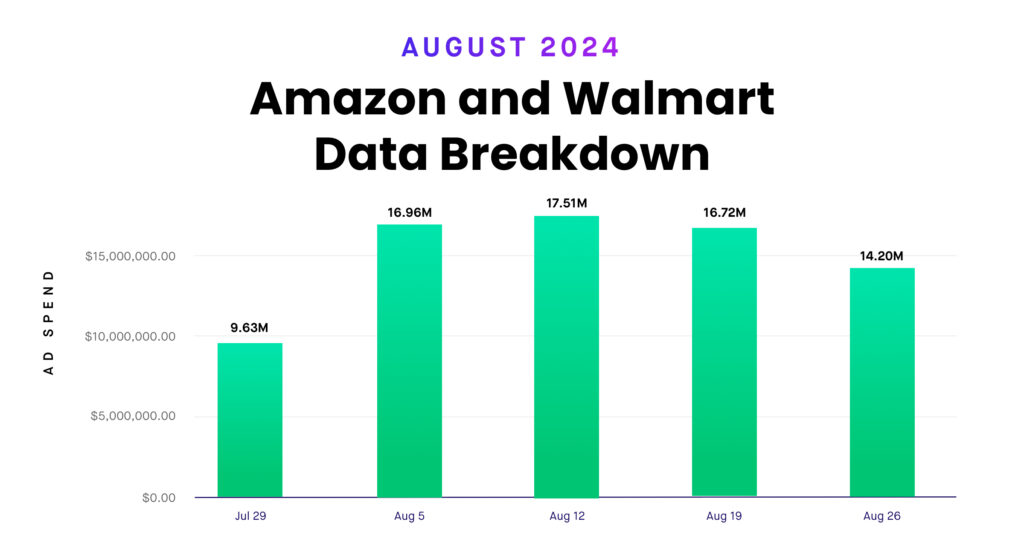

In August 2024, Amazon and Walmart experienced notable changes in advertising trends, primarily influenced by the back-to-school season and late summer shopping. As students returned to school and families wrapped up their summer plans, sellers on both platforms adjusted their ad strategies to capture the shifting consumer demand. Amazon’s ad spend surged as brands focused on school supplies, electronics, and fall fashion, while Walmart’s marketing efforts targeted home essentials, outdoor gear, and last-minute vacation items.

This analysis highlights the key advertising metrics for Amazon and Walmart in August 2024, focusing on ad spend, CPC, and RoAS. We’ll explore how sellers leveraged these metrics to maximize their reach during a highly competitive season. By comparing trends from the previous year and the transitions from July to August, we’ll uncover valuable insights into sellers’ evolving strategies during the late summer shopping window. This month set the stage for even greater momentum heading into the holiday season.

August 2023 vs August 2024

In August 2024, ad spend increased by 26.9% compared to August 2023. This surge could be attributed to several factors, including increased competition among sellers due to growing consumer demand for back-to-school items, fall fashion, and electronics. Additionally, shifts in marketing strategies, such as adopting more aggressive Amazon ads and Walmart campaigns, likely contributed to this increase. Sellers may have also capitalized on expanding advertising tools and targeting options to improve their reach and visibility during a key shopping season.

July 2024 vs August 2024

In July 2024, ad spend significantly increased due to major events like Amazon Prime Day and Walmart Deals. However, there was a 16% decrease in ad spend in August as the focus shifted to back-to-school promotions. This decline reflects the absence of significant shopping events, leading to more targeted advertising strategies. July’s peak spending occurred mid-month during Prime Day. Meanwhile, August saw steady investment, with the highest activity during the back-to-school season, aligning with consumer demand for school-related products and essentials.

Ad Spend, CPC, and RoAS Analysis: August 2024 for Amazon and Walmart

Amazon

Walmart

CPC (Cost Per Click):

In 2024, Amazon’s CPC increased 6.5% compared to 2023, indicating heightened competition as advertisers vied for valuable clicks. Walmart experienced an even steeper rise, with CPC increasing by 16%, reflecting the growing competition on its platform. This surge in cost is largely due to more sellers investing in ads, especially during key August shopping periods like back-to-school.

Ad Spend:

Amazon’s ad spend jumped by 25.7% from 2023 to 2024, showing a stronger commitment to capturing a larger market share during August’s critical sales window. At Walmart, ad spending increased by 35.4%, demonstrating the platform’s expanding advertising landscape as sellers capitalize on increasing consumer traffic.

RoAS (Return on Advertising Spend):

Amazon’s RoAS declined by 7.6%, despite higher ad spend, due to rising CPC and market saturation. Similarly, Walmart saw a 7.3% drop in RoAS as increased ad spend did not translate proportionally to higher revenue. Both platforms show that while sellers invest more in advertising, the competitive environment drives down returns per dollar spent.

In summary, the ad spend analysis for August 2024 shows a notable increase compared to 2023, highlighting the growing importance of strategic advertising on both Amazon and Walmart. With significant CPC and ad spend rises, sellers invest more to stay competitive during key shopping periods like back-to-school. Despite the increase in ad spend, the decline in RoAS reflects the challenge of maintaining profitability in a more crowded and expensive ad landscape. This underscores the need for sellers to fine-tune their campaigns to maximize efficiency and returns.

Ready to optimize your ad strategy? Teikametrics’ industry-leading AI can help you navigate these challenges with access to real-time data and precision-driven insights. Elevate your advertising game today—explore how with a free demo webinar!