November marked a critical phase in the holiday shopping season for Amazon and Walmart. With Black Friday and Cyber Monday dominating the month, sellers shifted their focus from fall campaigns to major holiday promotions. The competition intensified as brands worked to secure a share of the massive consumer demand for gifts, electronics, and seasonal essentials.

This analysis delves into November 2024’s advertising performance, breaking down key metrics such as ad spend, CPC, and RoAS for Amazon and Walmart. It highlights how sellers navigated the holiday shopping rush, leveraging targeted campaigns and increased budgets to capture consumer attention during this high-stakes month.

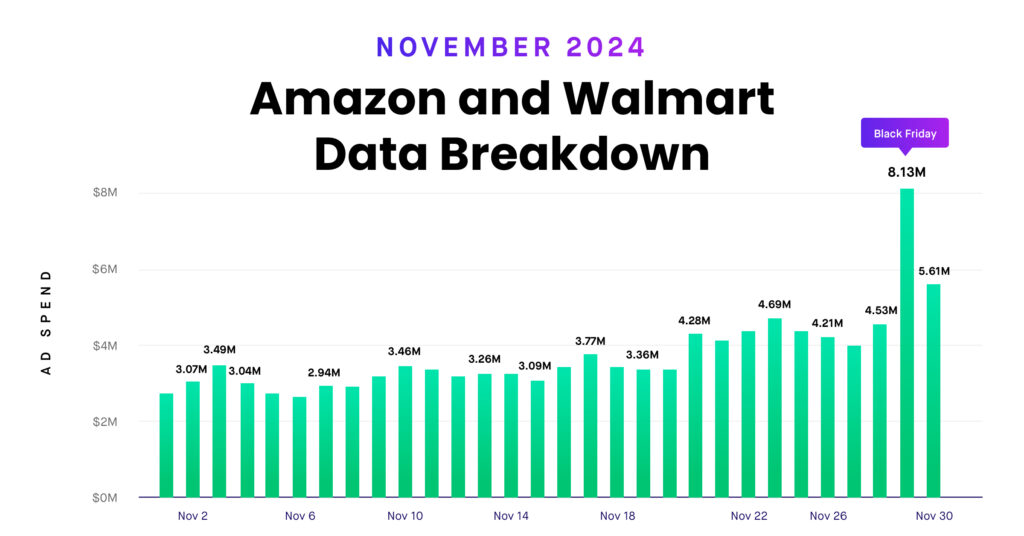

November 2023 vs. November 2024: Ad Spend Insights

In November 2024, ad spending surged by 32% compared to November 2023, reflecting heightened competition and increased investment in holiday shopping campaigns. Sellers capitalized on the holiday shopping momentum, focusing on capturing consumer attention early. Black Friday and Cyber Monday significantly drove this uptick, with both platforms leveraging their ad ecosystems to attract shoppers.

This rise is consistent with the general pattern of aggressive advertising tactics used during the busiest holiday season. In light of the growing demand for holiday goods, including gifts and seasonal necessities, sellers aimed to increase their visibility and reach.

October 2024 vs. November 2024: Monthly Performance Shift

Ad spending in November 2024 rose by 9.2% compared to October 2024. This growth can be attributed to brands ramping budgets for Black Friday and Cyber Monday, two of the most critical sales events of the year. November’s holiday-specific campaigns often include high-value promotions, encouraging sellers to increase their ad budgets to compete for consumer attention.

While October set the stage with fall-themed promotions and Halloween campaigns, November shifted focus toward high-demand holiday categories, making it a crucial month for sellers to optimize their advertising strategies.

CPC and RoAS Analysis: November 2024

CPC (Cost Per Click):

CPC increased by 2.3% in November 2024 compared to November 2023, reaching $0.88. This slight rise reflects the intense competition during the holiday season as sellers vied for premium ad placements. The holiday rush often results in higher bids, driving up costs.

RoAS (Return on Advertising Spend):

Despite higher ad investments, RoAS declined by 8.3% year-over-year, dropping from $5.76 in 2023 to $5.28 in 2024. This decline suggests that while sellers increased their budgets, the returns per dollar spent faced pressure due to rising CPCs and market saturation. The competitive landscape required sellers to focus on highly targeted campaigns and refined messaging to maximize profitability.

Key Takeaways for Sellers

- Increased Investment: Sellers must allocate higher budgets during November to stay competitive, especially around Black Friday and Cyber Monday.

- Rising Costs: The slight CPC increase highlights the need for efficient bidding strategies to manage rising advertising costs.

- Focus on Profitability: With RoAS declining, sellers should prioritize campaign optimization and audience targeting to maintain profitability during high-spend periods.

November 2024 proved pivotal as sellers navigated peak holiday competition. By refining ad strategies and leveraging analytics-driven insights, brands can better capture consumer attention and drive sales in a challenging yet rewarding environment.

Ready to enhance your holiday campaigns? Use Teikametrics’ AI-powered tools to optimize ad performance and precisely navigate competitive landscapes. Make this holiday season your most profitable yet!