October was pivotal for Amazon and Walmart as they began the holiday shopping season. Halloween campaigns received early attention, and holiday promotions quickly followed suit. Amazon’s Prime Big Deal Days, held on October 8-9, significantly increased ad spend and ad sales in electronics, toys, beauty, and apparel categories. On the other hand, Walmart shifted its focus to groceries, household items, and Halloween merchandise, catering to families preparing for the season’s festivities.

This recap dives into October 2024’s advertising performance, breaking down key metrics like ad spend, CPC, and RoAS for both Amazon and Walmart. It explores how sellers navigated the fine line between Halloween and early holiday promotions, using top-selling categories to fine-tune their campaigns during this crucial transitional month.

October 2023 vs October 2024

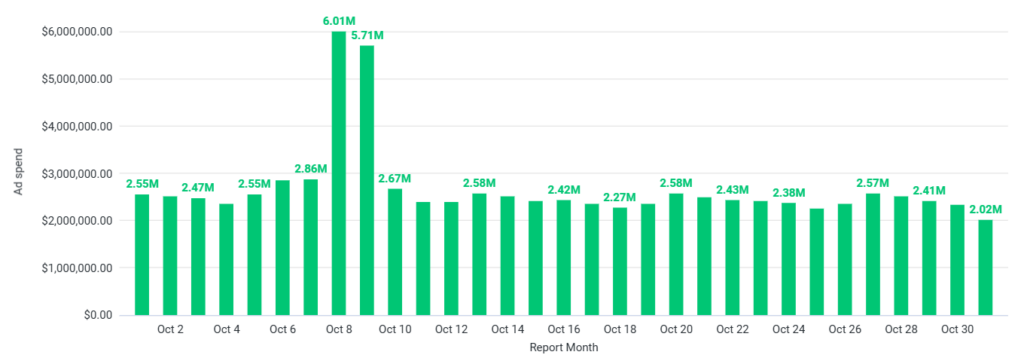

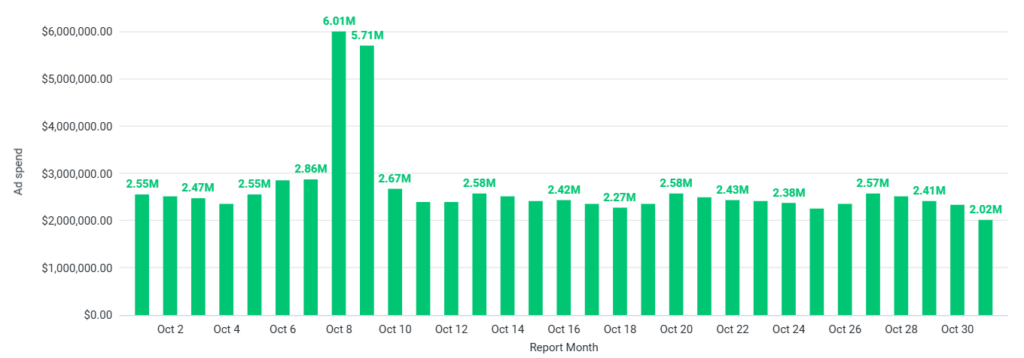

In October 2024, ad spending increased by 30% compared to October 2023, driven by higher competition and growing demand for fall and holiday products. A key factor in this surge was the Prime Big Deal Days, which took place in both years during October and offered significant promotional opportunities for sellers. Sellers ramped up efforts with mid-month promotions and more targeted ad strategies around this event. This rise reflects a broader shift toward more aggressive ad spending during peak shopping, indicating that sellers must adopt flexible marketing strategies to stay competitive and capture consumer attention.

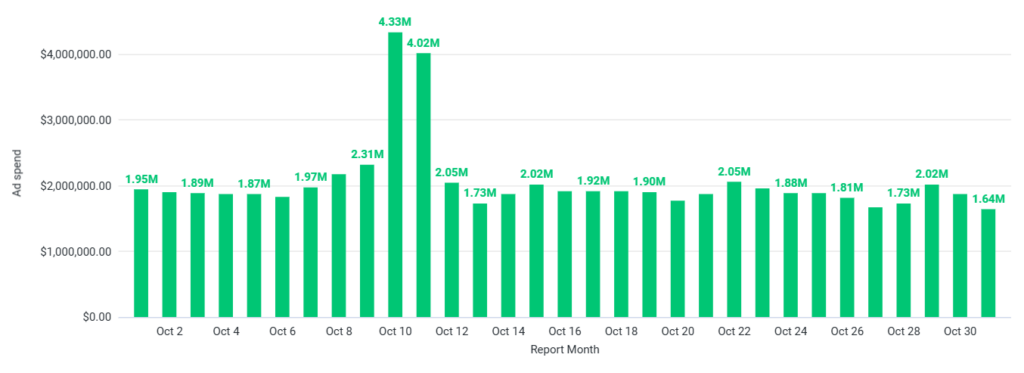

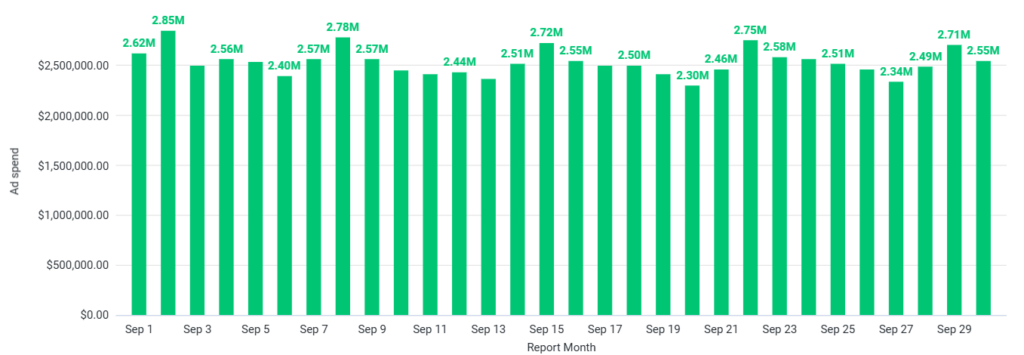

September 2024 vs October 2024

Ad spending rose by 9.1% in October 2024 compared to September 2024. This increase is likely due to brands capitalizing on the Prime Big Deal Days, a major sales event. Sellers ramped up their ad spend to attract early holiday shoppers and promote fall products, such as Halloween items and seasonal fashion. The growing competition for visibility during these key shopping days and a shift towards more targeted and aggressive marketing strategies led to higher ad budgets. Brands also optimized their campaigns strategically to boost engagement and sales during this peak period.

Ad Spend, CPC, and RoAS Analysis: October 2024 for Amazon and Walmart

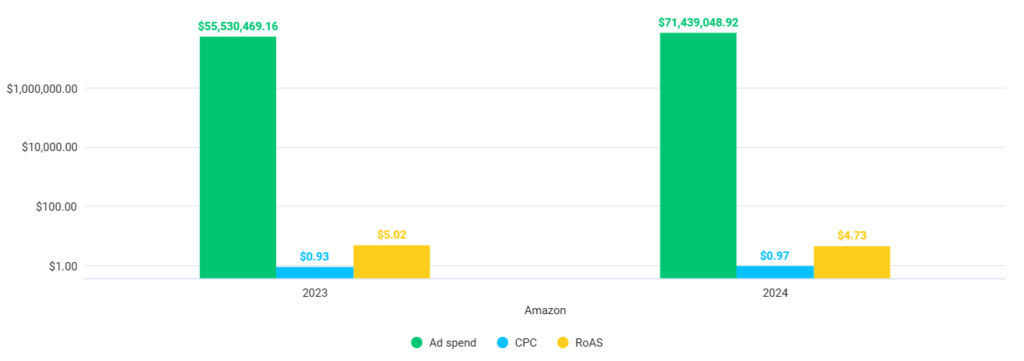

Amazon

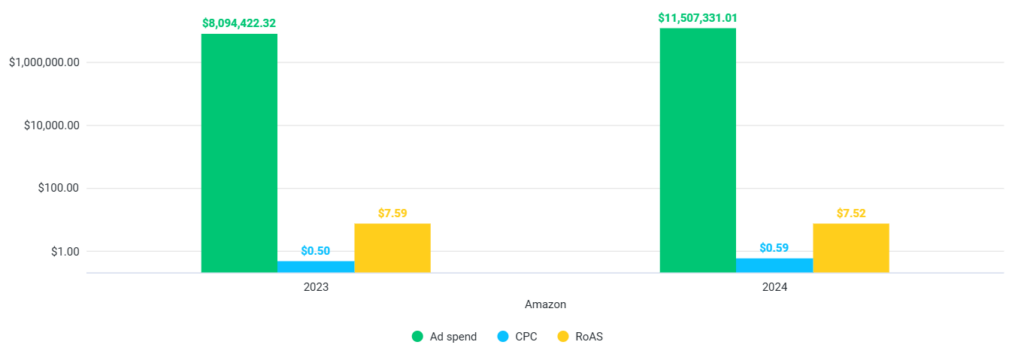

Walmart

CPC (Cost Per Click):

In 2024, Amazon’s CPC increased by 4.3% compared to 2023, reflecting heightened competition as more sellers bid for valuable clicks. Walmart experienced a more significant rise in CPC, increasing by 18%. This sharp increase indicates growing competition on Walmart’s platform as more sellers view for visibility during key shopping periods. The uptick in CPC for both platforms highlights the escalating cost of advertising as the market becomes more competitive.

Ad Spend:

Amazon’s ad spending increased by 28.6% from 2023 to 2024, signaling a strong commitment to boosting its presence during key sales. Walmart’s ad spending increased by 42.4%, demonstrating its growing ad landscape and the rising investment from sellers eager to capture consumer attention. Both platforms saw substantial increases in ad spending, indicating that sellers prioritize advertising to stay competitive.

RoAS (Return on Advertising Spend):

Amazon’s RoAS declined by 5.8% from 2023 to 2024 despite higher ad spend. This drop suggests that rising CPC and market saturation are making it more difficult for sellers to achieve the same return on their investment. Similarly, Walmart’s RoAS decreased by 1.8%, highlighting that even though sellers invest more in ads, the returns per dollar spent are not keeping pace with the increased costs. Both platforms reflect the challenge of maintaining profitability in a competitive ad environment.

Conclusion

The ad spend analysis for 2024 highlights a clear trend of increased investment in advertising on both Amazon and Walmart, as sellers aim to capture a larger market share during key sales periods. While ad spend and CPC have risen significantly on both platforms, reflecting heightened competition, the decline in RoAS signals sellers’ challenges in maintaining profitability. Despite the larger budgets, the intensified competition makes achieving the same returns on ad spending harder than in previous years.

For sellers, this underscores the importance of optimizing advertising campaigns, refining targeting strategies, and staying adaptable to a constantly evolving market. As competition grows, efficient and well-calibrated ad strategies will be crucial for maximizing returns and sustaining long-term profitability.

Ready to optimize your ad strategy? Teikametrics‘ cutting-edge AI empowers you with real-time data and precision-driven insights to tackle challenges effectively. Take your advertising game to the next level today