As we gear up for the second Prime Day event of 2024, set for October 8th and 9th, sellers must understand past trends and how to optimize their strategies for the upcoming sales period. This blog delves into a comprehensive analysis of Prime Day events from 2023 in July and October to extract valuable insights and predictions for October Prime Day 2024. By understanding shifts in ad spend, performance differences, and top-selling categories, sellers can better position themselves for success in the fast-approaching event.

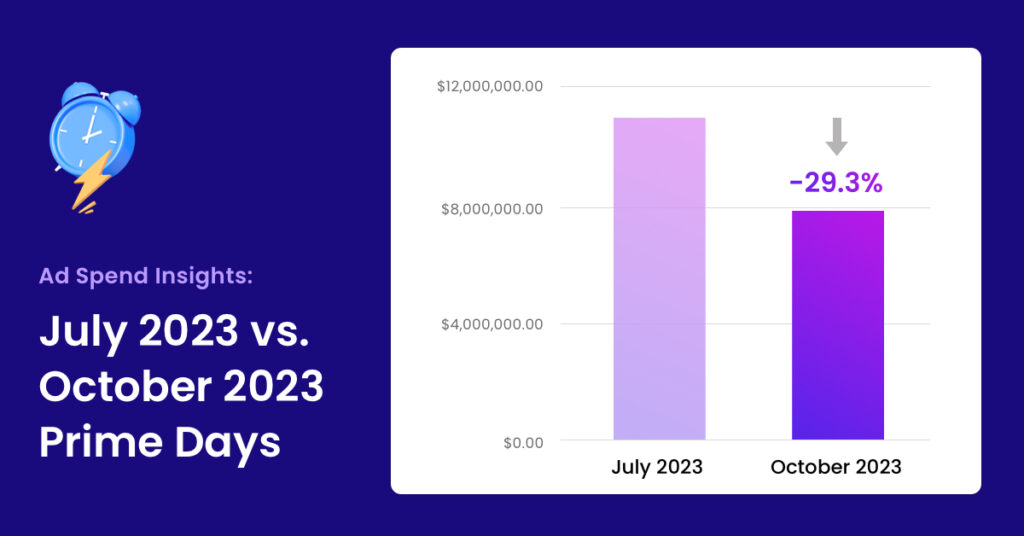

Ad Spend Insights: July 2023 vs. October 2023 Prime Days

Looking back at 2023, the comparison of July and October Prime Day ad spending reveals some significant trends that may influence your strategy for October 2024. In 2023, ad spending dropped by 29.3% between the October and July events. While July has traditionally generated more promotional buzz as a mid-year sale, the October event is often held close to other significant shopping days, such as Black Friday and Cyber Monday, resulting in reduced advertising budgets.

This drop in ad spend could indicate that sellers are becoming more selective about allocating their marketing budgets as the year progresses. In October Prime Day 2024, a similar trend could occur, with sellers holding back ad budgets for more significant upcoming sales events. For sellers this year, it might be wise to distribute ad spending more evenly across the holiday season or focus on conversion optimization rather than sheer volume.

October 2023 Prime Day Performance vs. July 2023

Despite the decrease in ad spend, October Prime Day 2023 still performed solidly, though the results were not as staggering as July’s. One primary reason for the difference in performance between the two events is timing. July’s Prime Day kicks off the summer sales rush and typically sees larger consumer interest, while October’s event is a precursor to November’s shopping frenzy.

The 29.3% drop in ad spend during October Prime Day 2023 did not necessarily imply a significant decline in performance. Instead, it reflected sellers’ more cautious approach, anticipating increased consumer spending later in the year. Shoppers in October may have been waiting for even better deals on Black Friday, resulting in a more minor surge than in July.

This is essential to remember for October Prime Day 2024. Sellers might benefit from focusing on more specific categories or customer segments, targeting early holiday shoppers looking for niche deals rather than broad-based discounts.

Top Categories: Consistent Winners in 2023

A few clear winners emerge from the top-performing categories during the October Prime Day 2023. These categories stayed consistent across both Prime Day events, suggesting ongoing demand that sellers should capitalize on for October Prime Day 2024:

- Home & Kitchen (27.4%): As the top-performing category, Home & Kitchen products are a consumer favorite. With the colder months approaching during the October event, consumers prioritize home improvement and comfort items, making this a solid category to focus on in 2024.

- Health & Household (15.2%): This category has remained strong throughout 2023. Consumers continue to prioritize health and wellness products, making it a reliable area for sellers to invest in during ad campaigns.

- Clothing, Shoes & Jewelry (10.6%): With the holiday season looming in October, shoppers are looking for gifts, and apparel and accessories remain key. This trend will continue in 2024, with early holiday shoppers driving demand.

Other notable categories include Beauty & Personal Care, Toys & Games, and Electronics, which also performed well and should not be overlooked when planning ad budgets for 2024.

Conclusion: Preparing for October Prime Day 2024

Based on trends from 2023 and the recent July 2024 Prime Day, ad spending is continuing to grow year over year. The 36.8% increase in ad spending in July 2024 compared to July 2023 reflects the heightened competition among sellers and the growing importance of Prime Day events. This upward trend in ad investment signals that sellers are more willing to allocate larger budgets to capture consumer attention during these key sales periods.

For October Prime Day 2024, sellers should consider this increase a benchmark, ensuring they optimize their ad budgets strategically to maintain competitiveness. While ad spend tends to dip during October compared to July, sellers should still focus on top-performing categories and leverage customer behavior insights to maximize conversion rates. With the October event positioned just before the holiday shopping season, it presents a prime opportunity to build momentum before the significant shopping rush.

It’s not too late to optimize your campaigns and be fully prepared for the upcoming October Prime Day event. A few strategic adjustments can make all the difference in maximizing your ad spend and targeting the right customers at the right time.

Ready to leverage these insights? Whether you’re looking to refine your eCommerce advertising strategy or gain a deeper understanding of your brand’s position, Teikametrics’ AI-driven tools are here to help. With near real-time data and automated optimizations, our software is designed to enhance your performance and help you achieve your goals. Discover the difference with a free demo webinar today and see how Teikametrics can elevate your success this Prime Day!

**The percentage values above represent each category’s share within the overall marketplace (US).**