Amazon Prime Day 2024, held on July 16th and 17th, has ended, leaving behind a trail of remarkable sales and significant consumer engagement. As one of the most anticipated shopping events of the year, Prime Day continues to redefine ecommerce, offering unparalleled opportunities for both buyers and sellers. This comprehensive wrap-up delves into the key trends and preliminary insights during this year’s event.

By analyzing crucial metrics such as sales figures, ad spend, and customer behavior, we aim to understand better what drove this year’s achievement.

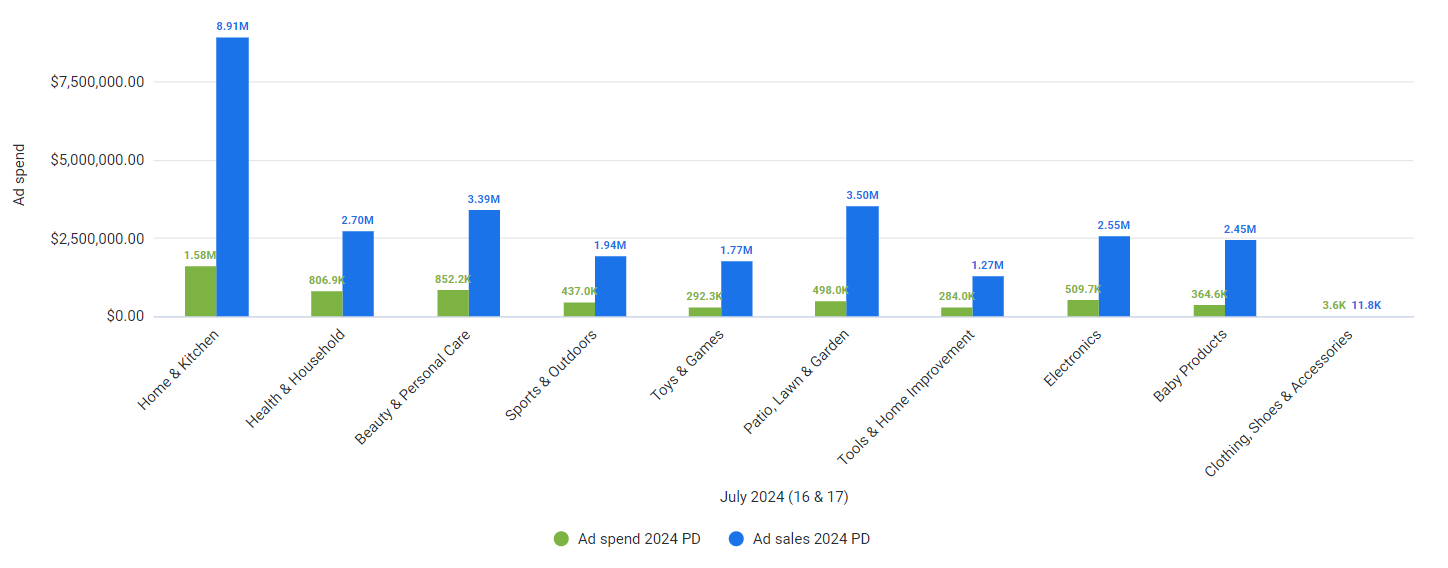

Ad Spend and Ad Sales Trend

Ad Spend Trend

The top categories by ad spend during Prime Day 2024 were:

Home & Kitchen: Ad spend increased by 11% in 2024, reflecting a strategic push by sellers to capitalize on growing consumer interest in home essentials amid a competitive market.

Beauty & Personal Care: Ad spend rose 32% in 2024, driven by heightened demand and increased consumer spending on beauty products.

Electronics: Ad spend grew by 29% in 2024, aiming to address market saturation and shifting consumer preferences in a fast-evolving tech landscape.

Health & Household: Ad spend decreased by 39% in 2024, reflecting a strategic pullback due to declining sales and lower market performance.

Clothing, Shoes & Accessories: Ad spend fell by 15% in 2024, highlighting ongoing challenges and reduced confidence in driving sales through advertising.

These categories indicate strategic shifts in advertising investments, with notable increases in segments typically seeing high consumer demand. Beauty & Personal Care and Electronics, in particular, demonstrate sellers’ confidence in driving sales through increased ad spend.

Ad Sales Trend

Beauty & Personal Care: Ad sales surged by 35% in 2024, driven by highly effective advertising strategies and a significant rise in consumer demand for personal care products.

Baby Products: Ad sales grew by 38%, highlighting heightened demand driven by increased new parents and successful targeted campaigns.

Patio, Lawn & Garden: Ad sales increased by 65%, reflecting consumer interest in outdoor living and practical promotional efforts targeting seasonal purchases.

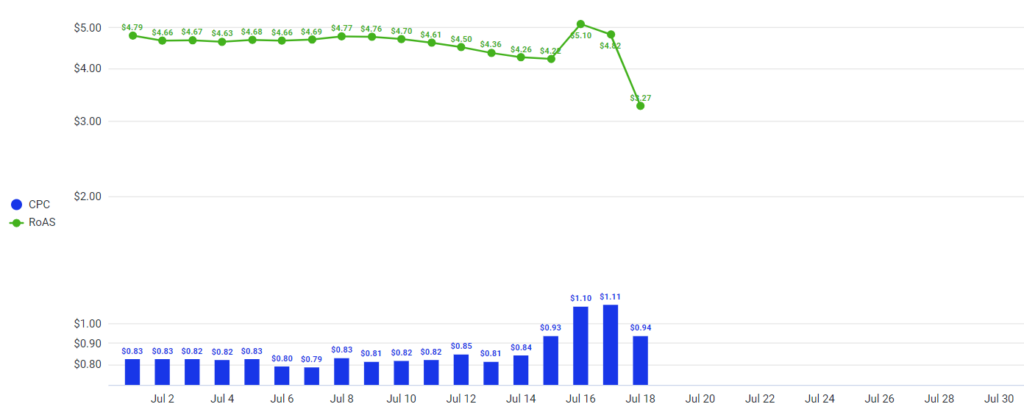

CPC and ROAS Trends

CPC Trends

July 16: CPC peaked at $1.10, a 33% increase from the monthly average of $0.83.

July 17: CPC remained high at $1.11, continuing the upward trend by 34%.

ROAS Trends

July 16: ROAS was highest at $5.10, representing a 20% increase compared to the average ROAS of $4.25 for the rest of July.

July 17: ROAS remained strong at $4.82, showing a 13% increase from rest of July.

The heightened CPC during Prime Day highlights the competitive landscape, while the favorable ROAS metrics underscore ad spend efficiency during this peak period.

Key Takeaways

These findings offer valuable insights into consumer behavior and market trends during Prime Day 2024. Categories like Beauty & Personal Care, Patio, Lawn & Garden, and Baby Products saw significant growth, driven by strategic ad spend. The high CPC and favorable ROAS metrics on Prime Day underscore the competitive nature and effectiveness of advertising during the event.

With Teikametrics’ leading software and team of e-commerce professionals, you have everything you need to improve your strategies, save time and money, and capture new sales simultaneously for the Big event. Find out how we can help you achieve your unique goals with a free chat. Talk to us today.

*This data is representative of the countries Prime Day takes place in: Australia, Austria, Belgium, Brazil, Canada, Egypt, France, Germany, Italy, Japan, Luxembourg, Mexico, the Netherlands, Poland, Portugal, Saudi Arabia, Singapore, Spain, Sweden, Turkey, the United Arab Emirates, the U.S., and the UK*

**This blog was published on July 19, 2024, which is still within the attribution window for ad sales**