In September 2024, Amazon and Walmart shifted ad strategies from back-to-school to early holiday and fall shopping. This transitional month saw brands focusing on seasonal products like fall fashion, Halloween decor, and home essentials. Amazon’s ad spent on fall items and electronics, while Walmart targeted home goods and groceries as consumers prepared for cooler months.

This analysis dives into the key advertising metrics for Amazon and Walmart in September 2024, covering ad spend, CPC, and RoAS. We’ll explore how sellers utilized these metrics to optimize their campaigns during a transitional yet crucial period. By comparing trends from the previous year and the changes from August to September, we’ll uncover insights into sellers’ evolving strategies as they prepare for the upcoming peak holiday shopping season.

September 2023 vs September 2024

Ad spending rose by 25.5% in September 2024 compared to September 2023. This growth is likely due to brands ramping up early holiday promotions and targeting fall shoppers earlier than usual. The shift in focus toward fall fashion, seasonal home goods, and Halloween products has contributed to increased ad activity. Additionally, enhanced advertising tools and refined targeting options on Amazon and Walmart allowed sellers to better engage consumers during this crucial shopping period.

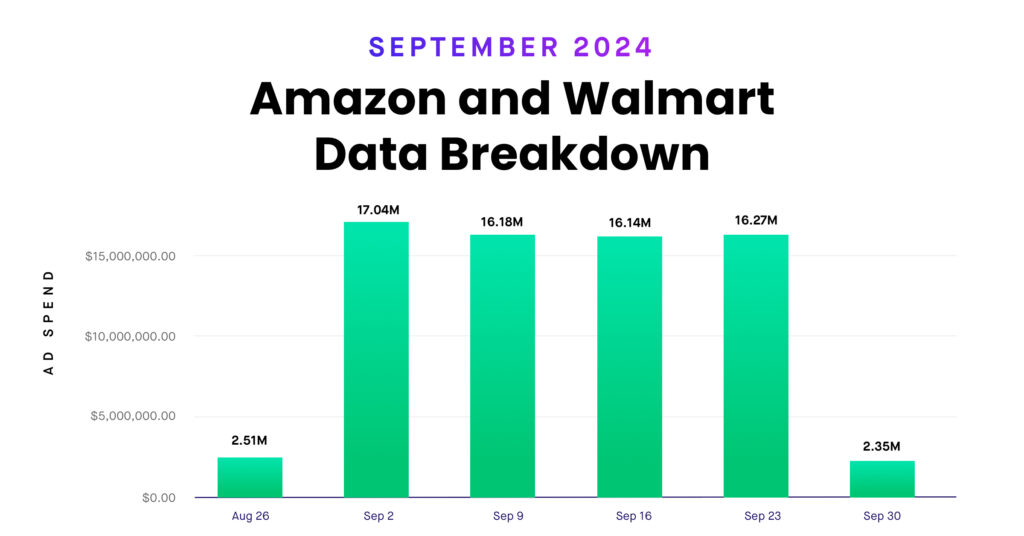

August 2024 vs September 2024

Ad spending rose by 15.1% in September 2024 compared to August 2024. This increase is driven by brands shifting focus from back-to-school to early holiday and fall promotions, capitalizing on the growing demand for seasonal products such as fall fashion, Halloween decorations, and home essentials. Sellers aimed to engage early holiday shoppers, resulting in higher ad budgets.

Unlike the steady ad investment in August, which focused on school-related products, September saw a more aggressive push toward maximizing visibility for holiday preparation items. Additionally, brands utilized advanced targeting options and promotional tools on Amazon and Walmart to optimize campaign performance, leading to a noticeable rise in ad activity throughout the month.

Ad Spend, CPC, and RoAS Analysis: September 2024 for Amazon and Walmart

Amazon

Walmart

CPC (Cost Per Click):

In 2024, Amazon’s CPC increased by 6.5% compared to 2023, indicating heightened competition as advertisers fought for valuable clicks. Similarly, Walmart experienced a more significant rise of 18.4% in CPC, reflecting the growing demand for advertising space on its platform. This increase in cost can be attributed to more sellers engaging in competitive bidding, particularly during busy shopping periods, which continues to intensify as brands seek to attract consumer attention.

Ad Spend:

Amazon’s ad spend surged 25.1% from 2023 to 2024, showcasing a more substantial commitment to gaining market share during critical sales periods. At Walmart, ad spending also saw a substantial increase of 39.8%, highlighting the platform’s expanding advertising capabilities as sellers take advantage of rising consumer traffic. The increase in ad spend on both platforms suggests advertisers are willing to invest more in visibility to enhance their sales performance.

RoAS (Return on Advertising Spend):

Amazon’s RoAS dropped by 9.8% compared to 2023, signaling that despite higher ad spend, the effectiveness of advertising is diminishing due to rising CPC and increased market competition. In contrast, Walmart experienced a smaller decline of 10.5% in RoAS, as its increased ad spend also failed to yield proportional revenue gains. This trend reflects a common challenge across both platforms: sellers invest heavily in ads, but the competitive landscape drives down returns per advertising dollar.

The ad spend analysis for 2024 indicates a significant increase compared to 2023 across both Amazon and Walmart, emphasizing the growing importance of strategic advertising. With noticeable CPC and ad spending rises, sellers are investing more to maintain a competitive edge. However, the decline in RoAS on both platforms highlights the difficulties in achieving profitability amidst a crowded advertising space. This situation underscores sellers’ need to refine their advertising strategies to optimize campaign efficiency and maximize returns.

Ready to optimize your ad strategy? Teikametrics’ industry-leading AI can help you navigate these challenges with access to real-time data and precision-driven insights. Elevate your advertising game today—explore how with a free demo webinar!