Prefer to save or print this information and take it with you? Download the ebook version.

The increasingly complex and competitive world of ecommerce on marketplaces like Amazon and Walmart poses ever bigger challenges for sellers, requiring you to keep a constant finger on the pulse of the market.

How do you discover the ways your competition is changing its strategy? How do you compete to get your products noticed in a crowded marketplace? How do you break through the noise of all the other brands shouting their messages into the market?

In this guide, we’ll offer answers to these questions. We’ll break down what we mean by “market intelligence,” explain how you can gather data on your competitors, discuss ways to leverage that data to claim market share, and offer tips to guide your market intelligence strategy.

→ Prefer to learn by watching a video? Check out our on-demand webinar 2021 Guide: How to Use Competitive Intelligence on Amazon & Walmart

Why Does Market Intelligence Matter?

Market intelligence refers to the data you gather about the position in the market of your product or brand. Market intelligence becomes powerful when you use it to drive business decisions.

For a marketplace business, market intelligence will inform you with a variety of data points such as the organic ranking of a product on a particular search term, what products you’re competing against, or how your product offerings compare to your competitors’ offerings.

You can leverage market intelligence throughout the lifespan of a product, including both launch and growth phases.

Market intelligence for launch

Sellers just launching a brand or product on a marketplace need market intelligence. You need to research the demand for your product and what products you’ll compete against. All that data will inform a successful launch strategy that activates the flywheel and propels product sales on the marketplace.

Market intelligence for growth

You also need to have market intelligence to remain competitive when you’ve established your products solidly on marketplaces like Amazon or Walmart and are looking for opportunities for incremental growth.

People look at market intelligence or market tracking tools, and apply it a lot into the research phase of maybe trying to figure out which products they want to sell, or categories that they want to expand into, but it’s really interesting how much you can use it during operations as well… In the last two years, I found myself trying to bring in a lot of that continued research as I’m operating.

Terms to Know

If you’re new to thinking about market intelligence, it can be dizzying to make sense of all the specialized language. Below we define some of the terms that you’ll need to understand ecommerce market intelligence.

We’ve also created a PDF version of this glossary, so you can download the reference sheet and keep it handy.

Brand coverage on search (BCS), also called Share of voice (SOV)

Traditionally share of voice refers to a brand’s percentage of advertising within the total advertising in the market. In the marketplace context, SOV or BCS refers to where your product ranks on critical keywords as compared to your competitors’ products.

BCS measures the percentage of placements a brand occupies on page one of search results. It tells you how frequently you capture placements on a particular term as compared to competitor brands.

Competition

The competition refers to other brands or sellers who offer products similar to yours on the marketplaces where you sell. Competition means shoppers have choices and may be selecting between similar products offered by different brands.

Competitive intelligence

Competitive intelligence involves gathering and analysis of data about your immediate competitors. Competitive intelligence becomes most useful when you link it directly to business decisions and actions. Compare to market intelligence.

Digital shelf

The internet answer to the retail shelf is the digital shelf. Think of the digital shelf as all the places online where a shopper can encounter your product. Sellers need to claim space on the digital shelf to give their products a chance for shoppers to discover them.

Market intelligence

Market intelligence is the gathering and analysis of data about the larger category, market, or marketplace in which your business operates. Market intelligence helps you to see the bigger picture of how your business fits into the forces surrounding it. Compare to competitive intelligence.

Market share

Market share refers to the percentage of total available revenue or share in your market that your business claims. Divide your sales by the total sales in your market (your sales plus your competitors’ sales) to understand your market share.

Organic product rank

Organic product rank is the organic position on a given keyword of a product in marketplace search results page where you as the seller don’t pay CPC if a user clicks on it.

Paid product rank

Paid product rank is the position of a product in marketplace search results page that is boosted by paid advertising.

How to Gather Market Intelligence

You need to make sure you’re measuring the relevant metrics for your business. For a complete picture of how your business is doing, you need to not only know your absolute performance but also how your business performs relative to the immediate competition, as well as the larger market. This tells you about the opportunity for growth and where you can capture more market share.

You could have sales that year-over-year have gone up 20 or 30 percent, which if you just look at yourself, you’re like, “That’s awesome, I’m doing great!” But if your overall market is going 40 percent, well you’re actually pacing behind your competitors in that case.

When you’re ready to conduct market intelligence research, you’ll be looking to identify your competition, understand their advantages, pinpoint their weaknesses, and compare them to your offerings and how your product performs. You’ll want to focus on collecting data that you can transform into action.

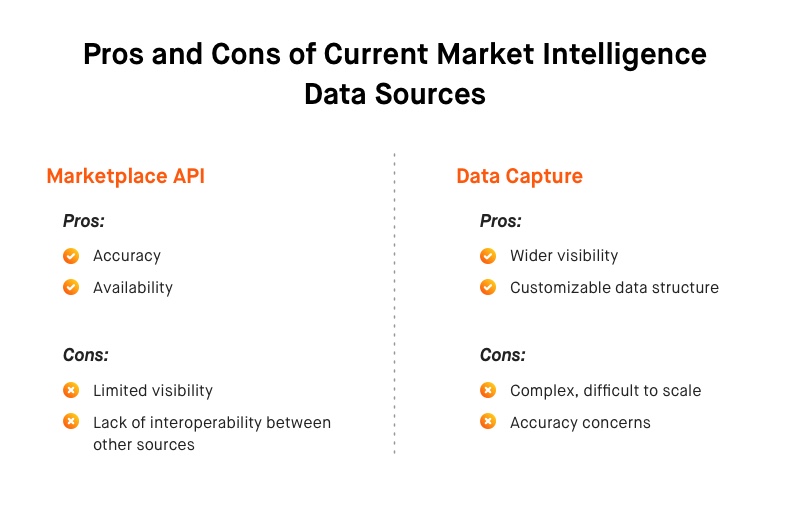

Data sources

Ecommerce sellers look to many sources when gathering market intelligence. These include manual research, reporting provided by marketplaces, as well as third-party tools, both free and paid. There are pros and cons to each of the data sources.

Wherever you source data, look at the quality of the data you’re getting. When you manually conduct searches on a platform it’s going to be colored by details like where you are and the time of day that you do your research.

The same limits can impede digital tools’ ability to capture data for you. The difference is that you likely will not be able to see what exactly prevents the data from being complete.

Manually tracking organic ranking

You can do a very manual tracking of your organic ranking by conducting regular marketplace searches for your product, counting where the product lands and recording in a spreadsheet. Keep in mind though, that these results will still be colored by your location, search history, etc.

Reverse ASIN/SKU/Product

When you manually search the keywords you’re interested in ranking on, you can identify competitor products that are ranking on those keywords. There are reverse ASIN/SKU/product tools available that you can use to then input the competitor ASIN/SKU/product and discover other keywords they’re ranking on that you might want to go after.

Marketplace reports

The marketplaces where you sell may also provide certain kinds of market intelligence data in dashboards and downloadable spreadsheets. You can also get data from marketplaces via an API.

–>For a detailed dive into how to conduct competitor intelligence on Amazon, read our blog by Alon Maltzov, General Manager, Market Intelligence, at Teikametrics.

How to Leverage Market Intelligence

Market intelligence is only as powerful as the business decisions you implement based on that data. You can leverage market intelligence data to launch products, grow your business, and address challenges. Market intelligence data should directly inform changes to your ad strategy.

Let’s map out an overview of ways you can use market intelligence to increase market share, protect your brand, expand to new markets, and diagnose performance problems.

Increase market share

Market intelligence will help you find opportunities to increase your market share and outperform your competitors.

When you uncover key terms for your products on which you’re ranking low, you can isolate those terms in a separate campaign on which you’ll bid aggressively. The tactic helps you to gain market share without wasting additional spend on terms for which you already rank well.

Protect your brand

Established brands that have been selling on a marketplace for a few years can utilize market intelligence to ensure you don’t cede any ground to competitors.

When you understand the trends in your product’s ranking, you can use that to determine whether and where you need to spend on advertising to maintain page one placement. You may need to allocate more spend for brand terms or Sponsored Brands ads to defend your brand.

I think something that people think about a lot is, if I’m organically number one, do I need to pay for a Sponsored Brand? Am I just paying extra to get a sale I would have gotten anyway? But it’s more complicated than that… If it’s not you, it’s going to be someone else, and that’s just a competitor for you.

Expand to new markets

When you consider expansion to new marketplaces, market intelligence can help you to determine which marketplaces offer the best fit for your products, and the shape of your launch strategy. This works whether you’re expanding from one platform to another, say Amazon to Walmart, or expanding internationally, say from Amazon U.S. to Amazon Mexico.

You can compare search volume and the presence of competition between marketplaces where you already understand the dynamics and marketplaces where you’re assessing the opportunity.

Diagnose performance problems

Every seller eventually has to deal with seeing their key metrics moving in the wrong direction. Having tools in place to diagnose why performance is dipping will enable you to turn that performance around.

A downward trend in sales might indicate that keywords you were ranking on are now being pursued by your competitors. You’ll be able to see how they’re claiming market share, by looking at share of voice data. You can either fight back by bidding more aggressively on your terms, or if the cost is too prohibitive, pull back from those and focus on keywords with more opportunity.

On the other hand, you might look at search volume and discover that while your clicks and sales trend down, so do the same metrics across your category. In that case, you can understand that larger market forces are at work, such as seasonality or shifts in customer demand.

Market Intelligence gives us a better picture to understand what kind of bidding strategy needs to be followed in order to rank high. BCS data helps us to target competitors’ ASINS and keywords in sponsored ad campaigns to drive sales and win sales over competitor brands.

Tie Market Intelligence To Business Decisions

Most sellers have to act like an octopus, extending all eight arms at once to manage an ecommerce business and pull data from multiple sources, download, manipulate, and reupload spreadsheets.

You become more powerful and more nimble when you combine market intelligence data with data on your inventory, ad performance, and finances. That’s because the combined data enables you to decide on smart business tactics in light of how they will impact every other part of your business.

Even very large amounts of data by itself isn’t necessarily all that valuable, but data that suggests actions is incredibly valuable.

When you advertise on a product, you are trying to improve your organic rank, but currently, through the Amazon’s API, you don’t have any information on where your product is positioned.

One option is to use Flywheel 2.0 to have all the data at your fingertips, integrated into one place so you can quickly make decisions based on the data and implement changes whether that be in advertising or inventory or other parts of your business.

Market Intelligence for Flywheel 2.0 provides powerful data on brand coverage on search and product data. Enter the search terms you wish to track and the marketplaces on which to track them, and Flywheel 2.0 produces actionable reports. The Brand coverage on search report below is a great example of the type of data you can track.

I rely on the BCS data I get from Market Intelligence in Flywheel 2.0 to monitor my client’s competition and inform our ad strategy. Seeing how my client’s brand coverage ranks against competitors on key search terms helps determine what strategies and optimizations we need to put in place to maintain, or improve, our ranking.

An Example

Eternal Essence Oils faces a lot of competition on Amazon. They tried to utilize advertising to beat the competition to top of search, but the ads they were running themselves were inefficient. They were wasting spend with inexpertly structured campaigns and missing out on major branding opportunities.

They turned to Teikametrics for help. In addition to implementing a more efficient ad structure, the Teikametrics analyst team also used insights from Teikametrics Flywheel 2.0 Market Intelligence to add product targeting and Sponsored Brands to increase brand awareness and claim more market share on Amazon.

What were the results? Year-over-year Eternal Essence Oils grew sales by 98% while improving efficiency with ACOS down 24%. Read the full case study.

Takeaways and Next Steps

There’s a lot to digest when you’re preparing a market intelligence research plan. You can fall back on the following takeaways to guide your strategy:

- Take a hard look at the blind spots in the sources of your current market intelligence.

- Understand the types of market intelligence that are valuable for your business.

- Define your goals for gathering market intelligence.

- Think about ways to tie data insights to tactical decisions.

- Plan to use market intelligence at all stages of your product lifecycle.

Get Flywheel 2.0 With Market Intelligence

Stay ahead of the competition. Understand your brand’s and products’ competitive positioning every day by tracking the most important searches shoppers use to find you on Amazon and Walmart. Ready to learn more about Market Intelligence for Flywheel 2.0?