Cyndi Thomason, founder of bookskeep and best-selling author of Profit First For Ecommerce Sellers, joined me to give actionable tips on best accounting practices for ecommerce businesses. Cyndi kicked off by telling attendees that many ecommerce business owners don’t quite understand how profitable they are – and profitability is important (of course).

Cash Path

Cyndi says the key to understanding profits is to understand your cash path. She also covered five levers to increase profit, and gave a comprehensive overview of owner pay and factoring it into your bottom line. Your cash path looks like this:

Cash -> Inventory -> Sales -> Profits -> Cash

It starts with the cash you used to pay for your first inventory order. All the product development costs and product testing costs are part of the cost of doing business, but once you put your capital into ordering the items you’re going to sell online, that starts your cash path. Once you acquire the inventory, package it and ship it into your ecommerce channels, you’re at the inventory stage of your cash path. THEN, you have to do what’s necessary to sell your inventory quickly at a good profit margin. Then, you efficiently convert revenue to profits, but you have to factor in your Cost of Goods, your cost of sales, shipping, packaging, duties and tariffs.

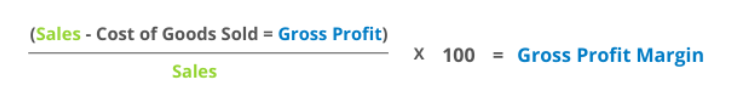

To understand your gross profit margin, you take your sales over a certain period of time, subtract the cost of goods sold (COGS) to calculate your gross profit, divide that number by the sales over that same time period, and multiply the result by 100. To simplify, the equation. looks like this:

Cyndi says that the goal is for your gross profit margin to be at least 30%. You want this for your overall business, but you need to drill down to the product level to see where you may be losing money, or to identify your most profitable items. Your gross profit margin must be adequate to:

- Reward you and build a rainy day fund

- Cover owner pay and taxes

- Pay for advertising your products

- Cover all operating expenses

- If desired, to attract motivated buyers should you decide to sell your business

In many situations, a business owner’s profit and loss statement doesn’t show things like loan principal repayments, inventory spend, payroll taxes (where applicable), sales taxes and owner draws for incidentals and owner pay. So, your profit has to be at a level to cover all these expenses, but leave your gross profit margin at 30%, at a minimum.

5 Levers to Increase Profits

Cyndi says the five levers to increase profits are:

- Revenue

- Expenses

- Receivable Days

- Inventory Days

- Payable Days

In the revenue category, you need to concentrate on attracting buyers, converting your advertising efforts into sales, managing returns in a way that you don’t lose your hat, and both increasing the frequency at which buyers purchase your items, but also scaling in a smart way the frequency at which you purchase new inventory.

In terms of expenses, it’s important to try to work with suppliers and manufacturers to get the cost of your inventory as low as possible (without sacrificing quality!), and properly managing your inventory so that you don’t face stock outs or excess inventory (fees, fees, fees!). You also have to take into account your advertising costs and other marketing costs. Cyndi recommends that once a quarter, you also look at your subscriptions, the tools you use, educational programs you may not use anymore, etc to make sure you’re not throwing money away.

We also gave a shout out to GETIDA – Yoni has educated our audience several times on the money Amazon might owe you. Check out our latest webinar with him to learn more about Amazon reimbursements.

In terms of receivable days, Cyndi says that it’s important to manage merchant processing fees (and to track them!), to optimize your listings for maximum conversion, and plan for reserves, since it’s vital that you have enough stock in on your ecommerce platforms, but you don’t have too much. If something happens and your shipment is delayed, do you have enough local inventory to satisfy demand? To know for sure, you have to calculate your inventory days. You do that by multiplying inventory value by the period of time you are examining, and divide it by your cost of goods sold.

You have to walk the fine line between having ENOUGH inventory, but not too much. Stock outs can hurt so many aspects of your business, and remember that Amazon also has the Inventory Performance Index Score that impacts your storage limits and fees.

Cyndi recommends that you negotiate longer terms with your suppliers and manufacturers to reduce risk, and to adjust payments to avoid late charges. The better your relationship with the companies you work with and pay regularly, the better.

Owner Pay

Cyndi says that she talks to a lot of ecommerce business owners that say they don’t want to pay themselves – they want to put all the money back into the business. She says, “the business was created to serve you!” How much cash do you need to fund your lifestyle? How much savings (runway) do you have, and what do you need to do for your business so that you have the profit you need to pay yourself.

Owner Pay Calculator

bookskeep has created an Owner Pay Calculator that you can access to see where you stand, profit-wise. Just visit this link to get your own copy and start using it to track your profitability!

Watch the full webinar replay:

Read the Transcript

Liz Downing (00:04):

Hi, everybody and happy Tuesday. This is Liz from Teikametrics. I’ve got my friend, Cyndi Thomason, with me from bookskeep. She’s a best-selling author and she’s going to give us some tips on being profitable with your Amazon business, your ecommerce business. Cyndi, say hi to everybody.

Cyndi Thomason (00:20):

Hello. Good afternoon. I’m glad to be with you and to have power.

Liz Downing (00:24):

Cyndi is in frigid temperatures in Missouri. I’m here in Richmond, Virginia. It’s about 45 degrees, which is odd for February but whoever you are, I hope you are safe and warm and you have power. There’s a few housekeeping items. This session is being recorded. We will be emailing it to all registrants along with any relevant links. We’ll also be writing it up on our blog there too and as well as on YouTube. Also, if you have questions for Cyndi or you have questions for me, put them in the questions section of GoToWebinar and we’ll address them as we go and we’ll have a Q&A section at the end. Without further ado, I think we’ll get started.

Liz Downing (01:05):

A little bit about Teikametrics. If you don’t know about us, we optimize your ecommerce business. Traditionally we have been in the advertising space for Amazon and Walmart but we’re expanding with our new Flywheel 2.0. We’re going to have inventory controls, access to capital financing and some really, really cool marketplace insights that I actually dug into today and it was kicking out over pretty hardcore. If you’re interested in any of that, email me. It’s ldowning@teikadev.wpengine.com, I’ll share that with you at the end of the session too. But let’s learn about my special guests today. Cyndi, why don’t you tell everybody about yourself?

Cyndi Thomason (01:46):

All right. Well, I’m Cyndi Thomason and I wrote the book Profit First for Ecommerce Sellers. It’s been out a couple of years now and basically what we like to do at my firm, bookskeep, is we like to help our clients know their numbers by getting the bookkeeping in order but also make sure that they’re profitable. We want to keep them as clients, so we need them to be profitable to be able to take care of what they want in their life but also to be able to afford us. So, it’s a win-win for everybody and we love talking about profit. I’m excited to… This is a new talk for me, I’m excited to share some new things today.

Liz Downing (02:24):

I’m excited too. I talk to many sellers and brand owners who don’t quite know what their numbers are and it’s hard to keep track, right? Because you’ve got however many marketplaces you’re selling on you’ve got things that are beyond your control in terms of fees on different marketplaces but there are things that you can control and there are things that you need to pay attention to that you might not be paying attention to. Let’s learn from Cyndi how we can be as profitable as possible. We have a picture that says we’re at the corner of Financial Street and Independence Road.

Cyndi Thomason (03:11):

Oh, okay. So I’m not seeing the screen, are you…

Liz Downing (03:13):

It’s because I’m not sharing yet. I should probably share that with everybody.

Cyndi Thomason (03:20):

I kept thinking we were going to disappear and I’d see something that was going to start it.

Liz Downing (03:24):

There we go.

Cyndi Thomason (03:26):

There we go. Okay. Awesome. Yeah. Let’s talk about why grow your profits. People have a lot of different reasons for wanting to grow your profits but people don’t always understand how to do that. That’s what we’re going to talk about today. There’s some reasons why you want to grow your profits and there’s some methods how. So, why do you want to do it? Many of my clients say they want financial independence, or they want to be able to fund a lifestyle where they are able to travel and be a digital nomad to operate their business from anywhere. Ultimately, what I think they’re searching for is peace of mind. What I hear over and over is that people are wanting to not have to worry about their business, to not have to worry about money. Profits are the way to get there. That’s what we’re going to talk about today. The three main things I want to cover today are: your cash path, your five levers to increase profitability and how to improve your owner pay. We should have another slide there for that Liz. There we go.

Liz Downing (04:16):

Cash path?

Cyndi Thomason (04:17):

Cash path. So, that’s what we’re going to start with. It all begins and it all ends with cash. And I want to walk you through the path that that money takes through your business because with the clients that we deal with, we hear a lot of confusion about why they don’t have money in their bank account. They get a profit and loss at some point, or they’re looking at an application that’s keeping up with profitability and they’re convinced they’re making money but they don’t know why their bank account isn’t growing. When it all comes down to the final counting, it’s the cash that we need to pay attention to. There’s a methodology for this that I want to expose you to. It comes out of a book written by Keith Cunningham, and a copy of it there for you to see, The Ultimate Blueprint For An Insanely Successful Business. The gentleman that wrote Rich Dad, Poor Dad talks a lot about his experience with the rich dad. The rich dad he’s referring to is Keith Cunningham.

Cyndi Thomason (05:46):

We’re going to the horse’s mouth here and letting him help us think about how cash works in our business. This is his path that he describes for us. We start with cash. And the purpose of our business is to use that cash to acquire assets. Whatever investment you put in your business, you’re going to use it to acquire assets, in our cases typically inventory. And we want those assets to be as effective as possible for generating revenue or sales because we bought that inventory not to just have a big inventory balance but to be able to convert that into sales, which is our revenue. When we have that revenue, we have to be very efficient about converting it into profits and then be very productive about using that to continue to create cashflow in the business. That’s our flow. The path starts with cash and it ends with cash. In the middle, it’s what we do with inventory to generate sales and to generate profits that leads us to more cash that becomes a circular thing.

Cyndi Thomason (07:05):

Let’s start then with the cash piece. Where did the cash come from when you started your business? Most of the time, people have some bank that they apply to buying their first inventory order. Most of the time they’re not thinking much about paying themselves, or taxes, or operating expense. The big thing that they’re thinking about is, how am I going to fund this big inventory order? And I would suggest to you that whatever cash that you’re putting into your business… I’d like to give you a tip and make sure you think about the fact that not only do you need to fund your first order, you need to fund at least a second order as well. The timing with cash coming back to you through your sales platforms many times is delayed, especially through Amazon, that until you get your money, you’re already having to place that second order. When you start out with your cash at the beginning, give yourself at least two inventory orders knowing that you’re going to be able to fund that, otherwise you’re going to buy your product and then be stuck with stock outs and lose a lot of momentum that you gain in the very beginning.

Cyndi Thomason (08:14):

So, when we use that to buy our inventory, that inventory that we purchase is there for the sole purpose of generating revenue. So we want to make sure that the inventory that we buy is going to be effective at generating that revenue. Let’s go to that next slide, Liz. There’s a couple of things that you need to think about. As you’re investigating products, the two main things you need to be looking into is how quickly are those products going to sell and are they going to generate good profit margin? I’m going to dig into profit margin here in just a minute. But the how quickly things sell really does impact how long your cash is going to be tied up to be able to buy the next product, or to replace the products you have. As you’re considering products, think about how quickly they’re going to sell and are they going to generate a good profit margin?

Cyndi Thomason (09:18):

Let’s talk about what is involved in calculating the profit margin. After we have our sale, then we’re left with what we call gross profit margin, in this slide, we’re just going to call it profits. The cost of goods sold, what you’ve bought with the inventory that you bought, when you actually sell it, it moves from being an asset on your books over to being a cost of goods on your P&L. We have to think about what those costs are, and we have to think about what other costs are going to be involved with making that product sellable. There’s shipping, there’s packaging, there’s duties and tariffs. All of those things will fit into your gross profit calculation. And that’s what I want to cover with you today. In this next slide, we talk about how you make that calculation. We want to maximize that gross margin, and if we can go to that next slide, Liz.

Liz Downing (10:28):

Is this the right one?

Cyndi Thomason (10:30):

There we are, yeah. We want to maximize-

Liz Downing (10:32):

What’s your…

Cyndi Thomason (10:34):

We want to maximize your gross profit margin. The way to determine your profit margin, if you’ve not been looking at this, is to take your sales, subtract from it your cost of goods sold and your cost of sales, and you’re left with your gross profit in terms of dollars. When you divide that by your sales and multiply it by 100, you get a gross profit margin. Now in the real estate industry, I’m sure everybody’s heard the buzzwords are location, location, location. In our business, it’s gross profit margin. That’s the thing you’ve got. If you don’t have any other metrics that you’re paying attention to, this is the one that you have to pay attention to in your business. Quite honestly, it’s the one every business has to pay attention to.

Cyndi Thomason (11:23):

But in an ecommerce business, you’ve got to get to the place where you know what your gross profit margin is not, only for your whole business but each product itself how it’s doing. And the goal we’re looking for there is, we want it to be at least 30%. And that’s a good number for any business. If your gross profit margin is above 30%, then you’re going to be able to keep buying inventory and keep it flowing, and you’re also going to be able to pay your operating expenses. Let’s move one more slide in and talk a little bit more about some of the places to be applying this gross profit margin.

Liz Downing (12:08):

Quick question Cyndi. If you’re a brand owner, or even if you’re a reseller, do things like product inspection and quality inspections and those kinds of things, does that wrap up into your COGS, your cost of goods sold?

Cyndi Thomason (12:25):

No, because really those items are a cost of doing business. Whenever we talk about cost of goods sold activities, they are the items that are going to increase the value of your product. If you’re going to put an additional feature on your product, maybe you’re going to expand your line with some additional features. Those kinds of things can be considered cost of goods sold but things like the cost of doing business for inspections, that kinds of things, those do not.

Liz Downing (13:04):

Thanks for clarifying that.

Cyndi Thomason (13:05):

Sure. So, we want to look at this, as I mentioned for your overall business, but we also want to look at it for each product. And you want to do this on a regular basis because we will see clients who are teetering at 25, 29% gross margin and they generalize and think that’s what’s being applied for all of their products, but in reality, if we dig deep we see some products are selling much higher and other products are selling much lower. So, a business that may have five or six different products that they’re bringing to market, they’re not all going to be at the same level. You’re going to have some real winners and you’re going to have some that aren’t contributing as much to your bottom line. You want to look at it by product to understand how each product in your portfolio is, in fact, helping you reach this goal of 30% gross margin.

Cyndi Thomason (14:16):

And the reason it’s important is because it’s got to be adequate to pay for all of these other things. As I mentioned earlier on, the book I wrote, Profit First for Ecommerce Sellers is all about paying the owner. Rewarding the owner with profit. Covering owner pay and taxes. Covering your advertising expenses and your operating expenses. But in the end, many of our clients come to us with the idea that they’re going to build up their brand, and build up their business, and then they’re going to want to exit. You want to have things in order and be driving profit in your business so that you can find those motivated buyers when you get ready to sell. That’s why profit is really important but it’s not the end of the equation. Let’s look back at this cash path for a second and you’ll see once we get to profit, and it’s really a common thing, most of our clients or people that come to us when they first start working with us, they are worried about their bottom line and their profits. But they’ve got to think one step beyond that and that is what cash is going to go back into the business. There’s some key expenses or key things that you pay for that don’t show up on your profit and loss.

Cyndi Thomason (15:47):

Let’s look at this next slide and… Actually one more in and look at these items that you’re not going to see typically on your profit and loss. When you are buying your inventory, if you do your books the way that we recommend, which is a modified cash, or modified accrual method, which means that you’re going to keep inventory on the balance sheet and after it sells, you’re going to then move it over to your P&L so you can match up sales that you made to what your cost of goods are. That’s what allows you to see that gross profit margin. When you actually buy inventory and you have to spend your cash again to buy inventory, you’re not going to see that hit the P&L. It doesn’t hit there until its sales. It shows up on your balance sheet. If you got a loan. The principal payment that you make reduces the liability on your balance sheet. You don’t see it on your P&L. So if you don’t have enough money at the very bottom line to cover your loan repayment, you’re not going to… You’re looking at information that’s not telling you the whole story.

Cyndi Thomason (17:10):

For people that have payroll taxes, or maybe you’re selling on a platform where you have to keep up with your sales taxes, if you owe those taxes that shows up on your balance sheet. And this is the one that confuses people a lot. They may take owner draws out of the business to pay themselves but they don’t realize that that’s not coming off of the P&L. These are the main categories of expenditures that you make, where cash is going to leave your business but it’s not going to show up on your P&L. Let’s go one more slide. That’s the cash path. We’ve walked through what the cash path is in the business and now I want to talk about that profit that we’re trying to get to. What can we do to improve and increase that profit? There are five levers, and these are five levers that apply to all businesses but we’re going to talk specifically today about how these levers apply in ecommerce businesses.

Cyndi Thomason (18:20):

Of course, you can do things to improve your revenue. You can sell more. That’s going to make your profit better as long as you’ve got a good profit margin. You can reduce your expenses and those expenses can be your cost of goods sold type of expenses, your product costs when you negotiate with a supplier, et cetera. You can try to improve your receivable days. This is a little harder for our ecommerce businesses and we’ll talk about why. We’re going to talk about inventory days and payable days. These are the five things. If you’re interested in knowing the metrics to be paying attention to, that’s what we’re going to dive into. First of all, gross profit is the big number. These are the things that help you get to that gross profit number. Let’s start with revenue and that’ll be our next slide. This is not my area of expertise. I think this is an area where most of my clients come to me and they have spent the bulk of their time understanding this number and these metrics, and I think it’s awesome. How do you attract your clients? How can you be efficient at that? How can you convert them? What are you doing to manage your returns and to increase your frequency of purchases?

Cyndi Thomason (19:35):

Those are just some ideas that I hear from working with my clients. I am not an expert on any of them but they’re the kinds of things you need to be paying attention to, and most of you probably are because I think this is where my clients tend to have… Most of their energy is put into this generating revenue. And I know recently you guys had Yoni in from GETIDA and his product really helps with managing returns. Do get to know what goes on here. We had a big win for one of our clients this week. They had never given us access to all of their Amazon platform, and when they finally did that this week, we realized that there was $97,000 sitting there in a fund that was waiting to pay out to them. It had been there for two years but they had never put their bank account information in, in this particular part of Amazon. And as a result, they were collecting their sales stuff but they weren’t collecting their Amazon Pay stuff. It’s a happy day to tell a client you found them nearly $100,000 but you’ve got to watch all of this stuff because even though you’re doing everything you can on the revenue generation side, there’s pieces of it you got to be sure you’re collecting too.

Liz Downing (21:01):

Definitely. We did have Yoni here and there’s money on the table at Amazon. I don’t think most people have not put in their bank account information to get their Amazon payments, but that’s the thing about Amazon, is that just because you put something in one part of Seller Central doesn’t mean it carries over to another part of Seller Central. Seller Central is the great big place and Amazon’s constantly trying to improve the sellers experience within Seller Central but it’s still not perfect. You have to make sure all your I’s are dotted, all your T’s are crossed or you could end up… But what a great day for your client, Cyndi, wow!

Cyndi Thomason (21:40):

Yeah, we were pretty excited and the bookkeeper that found it actually had found this for one other client about six months ago and it has to do with the Amazon Pay. You may be getting… He was getting all of his settlements but he was using Amazon Pay, and in that part of the portal he had not put his bank account information in. If you’re using Amazon Pay, be sure you’re getting your money from it.

Liz Downing (22:07):

Happy new year though, right?

Cyndi Thomason (22:08):

Yeah exactly.

Liz Downing (22:10):

When numbers are looking way better.

Cyndi Thomason (22:14):

For sure, for sure. Let’s talk about expenses. The expenses are really everything that you spend money on. It can be the suppliers where you’re paying for your product. You may be paying for your packaging. All of those kinds of expenses matter. Managing your inventory, that matters and advertising. These are three big buckets that you need to pay attention to. Then the last piece under expenses that we encourage our clients to do on a regular basis. Every three months, we encourage them to go through and do this cut, reduce, keep exercise. Go into your… Particularly, if you’re not going to do it for all of your expenses, go into your subscriptions expenses and look at it and say, “Am I using these products? What of these can I cut?” Or, “What am I not using as fully as I once did that I can reduce my plan.”

Cyndi Thomason (23:23):

And if it’s bringing value to your business, of course you want to keep it but making yourself this exercise of every quarter, what can I do to cut, reduce, or keep my operating expenses? Because anything that you cut or reduce, the money that you cut for that, stays in your pocket and is able to help you fund your salary. Fund your profits in your business. If you’re wanting to grow in another direction with another line of products, or add on to your existing line, it takes cash to do that. If you’re tying up all your money into things that are not generating value for you, then it makes it harder to have the funds have that cash to put back into buying new inventory.

Liz Downing (24:15):

I talk to a lot of sellers and brand owners that have tons of subscriptions all over the place to different… Sometimes there’s even some redundancy within the types of automation tools that they’re using. If you can have to combine two automation tools for say inventory management then that’s hunky dory, but if you’ve got three different systems that you’re paying for that are giving you alerts, or requesting reviews, or something like that, then really auditing, paying attention to what’s coming out of your bank account is super important. I’m all for automation obviously, or I wouldn’t be where I am but you have to be smart about the automation that you choose. You have to be smart about the people that you paid to advise your business. It’s a balancing act and you don’t want to sacrifice the quality of your product in order to keep redundant processes in place.

Cyndi Thomason (25:09):

Yeah, for sure. And many times we go in with the mindset of, ‘I’m going to try this out’, and in trying it out we put our credit card in but then we don’t think about it. Six months to a year later we look and, “Why am I still paying for that?” And you’ve totally forgotten it. We’re busy people and so-

Liz Downing (25:29):

Like what happens with free trial and it rolls over and you get charged and you don’t even realize it. That happens to people. It happens to me all the time.

Cyndi Thomason (25:36):

Yeah, me too. And if you make it a habit to look at subscriptions and you have that in your accounting software, you have subscriptions all in one bucket, it’s really easy. Pull it up, sort it by vendor and say, “Okay, yeah. I’m not doing that, using that surface anymore. Let’s take it out.” Okay. The next one there is receivable days. This one we don’t have as much control over. You may have some options to get your settlements from Amazon on one schedule or next. Typically, some of those options come with expenses, so you want to be careful with that but do pay attention to your merchant processing fees, make sure your listings are optimized and go into it expecting that there are going to be reserves withheld. When a business comes to us and say they’re just starting to ramp up and we’re so excited to see the sales that they’re getting but then when the settlements start coming through, they’re nowhere near what their sales are because Amazon’s holding out the reserves for a few months.

Cyndi Thomason (26:56):

Plan for that because if you are going to need that money to buy more inventory knowing that they’re going to withhold a portion of it can help you plan your cash better, so know that going in. We do see it with clients that are fairly new and bringing their products onto Amazon but we also see it when a client may have been selling that product for a while but then it really accelerates, and when that acceleration happens it will kick in again. So, know that reserves can happen in a couple of different scenarios. And what that means is, your ability to get that cash based on that sale is drug out and instead of getting it every two weeks, it may be a month, or six weeks before that money comes into you. Plan for that. It’s not something that’s insurmountable, if you know it’s going to happen, you can operate your cash a lot better.

Cyndi Thomason (28:06):

Inventory days. As I mentioned, when you make that first purchase and you’ve got your inventory, we want to see how quickly you sell through. When you’re first starting out, you don’t really have a lot of data on this but start collecting the data so you know how your products are performing. Your inventory value times the length that you’re looking at. Say, you want to look at your inventory days over the last year. Then you divide it by your cost of goods sold. And it’ll tell you the actual days that your inventory is typically held. It’s a good number to know because you want to… You’re trying to hit the sweet spot where you don’t hold onto it too long because you’re tying up your cash but you don’t want to manage it so low if you’ve got the potential for running out of stock. If there’s plenty sitting there that you can put in the next day you can manage it much lower but if you’re waiting on a product to come across the ocean and it’s 60 days to get here, and another 20 days to get it in Amazon, then you don’t want that number to be so low that you’re in danger of a stock out.

Liz Downing (29:33):

There are two things: One, with COVID. At the beginning of COVID, there were restrictions on what you could send in the FBA. When an X-factor like that comes up, you have to pivot quickly and come up with an inventory strategy that fits your business and will keep you profitable. Second thing is that not only will mismanagement of inventory negatively impact your bottom line, but you actually get punished by Amazon if you don’t manage your inventory well. It didn’t use to be that there were consequences from Amazon on mismanaging your inventory, but they introduced the inventory performance index score a couple of years ago. If you fall below the threshold that Amazon sets for a given quarter, you’re restricted on how much inventory you can send in the next quarter because you’ll have storage restrictions and you get hit with fees. We did have a question. Do fees like Amazon fees, returns, allowance, and that kind of stuff, that all rolls up into your cost of goods sold, right?

Cyndi Thomason (30:36):

Yes, we do. I see this debated. Here’s the reason why we put it in cost of goods sold. If you’re a brick and mortar store, you’ve got options about what credit cards you may take, or maybe you don’t. Maybe you decide to take cash and checks. When you sell on Amazon, that’s your store. That is your only option. It’s not discretionary. You don’t get to decide, “Well, I’m not going to pay Amazon’s fee today.” They took it before you ever saw the money, right? So, it’s a cost of goods sold in our world. Okay, let’s go down to payable days. Now, this is something you do have control over. You can negotiate with your supplier, ask for longer terms for making your payments to them. I have a client, just blows my mind, she negotiated that she was not going to pay for all of her inventory until it was sent into Amazon. And this person was making products and keeping them in their warehouse, and they sat there until she sent them into Amazon and she never paid for those products. It was an amazing deal.

Cyndi Thomason (31:54):

Those deals are out there. See what you can do to negotiate longer terms and to negotiate lower minimum order quantities. Because what you’re trying to do here, of course, we’re trying to increase profit, but we’re also trying to tie up less cash for longer periods of time. So, see what you can do to negotiate. You might be able to negotiate to make payments weekly, you always want to avoid late fees because you’re paying for nothing there. The key to working out all of this is to develop relationships with your suppliers. The clients that I’ve really learned a lot from over the last five years are all really skilled at working with their suppliers and figuring out how they can both benefit from managing their inventory. I’ve seen some very creative relationships where products are held at the vendor, sometimes they are held at a vendor in China, then a partial shipment is kept at a warehouse in the United States. There’s some really creative things out there that people are doing. But you can’t do any of that If you don’t have a relationship with your supplier and invest the time in doing that.

Cyndi Thomason (33:23):

So, the reason we’re trying to increase our profits ultimately is because we want to better manage our owner pay. The owner pay is your reward out of the business to fund these things that our clients all say they want. They want financial independence, they want to be free to travel and operate their business from anywhere, and ultimately, they want that peace of mind. To get to that place, we have to figure out how we’re going to take money out of the business. We like to do that with our clients, using a tool we call the owner pay calculator. It’s pretty simple to use, and I’m going to share it with you at the end, but I want to talk with you about the inputs that you’re going to need to go into this calculator. First of all, the first thing you have to get your head around is that the business was created to serve you. I can’t tell you how I have to argue with people that want to tell me that they’re not just going to take any money out, they’re going to leave it all in the business. It’s a bad idea.

Cyndi Thomason (34:41):

It’s a bad idea for a few reasons: First of all, if something were to happen to you and you were not able to operate the business, somebody else is going to have to be paid to do that. If you’re not going to take that money for operating the business but then it becomes an expense later when you have to pay someone, it’s a big shock to the business. And while you’re operating that way, you’re creating more money to do other things and it’s not putting the right pressures on the business. It’s leaving too much, typically in affix to fund things that aren’t necessary. So, paying yourself creates the habit of paying yourself so that even if you decide you want to hire a manager and step back from the day-to-day piece of it, you can do that because you’ve been putting money aside for your owner pay. Realize from the very beginning that the business was created to serve you. If you don’t use money, take money out of the business to pay you for your operations, people start to resent the business and family start to resent the business.

Cyndi Thomason (35:58):

I can tell you, as a business owner our mind is always working on the business. Always. Then if the money is never coming out, it just creates a bad dynamic in people’s lives. So, the business was created to serve you, that’s your motto. Then think about these three questions: How much cash do you need each month to fund your lifestyle? How much savings or runway do you have when you’re getting ready to launch this business? How much do you have to sell to get the profit needed to fund that lifestyle? Those are the kinds of things that I encourage people to think about because ultimately, this business is, at least with the people we work with, when they start the business it’s ultimately with the idea that this is going to become their business. And if they’re working in a corporate job or some other job, their idea is to move into a situation where this pays for their livelihood.

Cyndi Thomason (37:10):

Let’s look at this owner calculator and figure out the inputs that you have to have to understand how you can afford to pay yourself and have the business support you. This is a spreadsheet that we’ve created. There are three places where you have to input information. I’ve talked about profit first, just briefly. One of the things that profit first has done is looked at all kinds of businesses, all kinds of successful businesses, let me say that, and it tells you how much your owner pay should be based on what your gross margin is out of that business. If your business… You can look at your P&L in your real revenue, and I’m making a little bit of a leap here in profit first terms, but we’re going to equate real revenue to gross margin. And that’s not exactly right, if you were in a profit first class I’d teach you different, but I want people to just get the feel for this.

Cyndi Thomason (38:16):

So, if you’ve got gross margin of, say it’s in the 250 to 500k range, then you’re going to put column B, you’re going to enter a B here in number one. So, just by looking at your P&L and looking at your gross margin, you know you’re in column B. What that tells us is, all the businesses that Mike Michalowicz researched as part of his book, Profit First, what he determined is how much you should take as owner pay if you are in this bucket, in bracket B. I think that numbers 35%, although it’s really hard, it’s tiny and hard to see, I can see it on my screen, 35%. So, that tells you that about 35% is what you should take out of the business. So, you’re going to put column B here in number one. You’re going to have thought about what your personal income should be, and you’re going to put that in the box there, number two.

Cyndi Thomason (39:20):

If you want to make 50,000 a year, you’d plug 50,000 in there. And if you know your gross margin is, say 30%, you plug that in box three. Then what that does is it will calculate for you what your real revenue should be. I really should have put that in here with a number in it, I’m seeing that now, but the nice thing is you can do this for your business. We have the owner pay calculator available to you so you can do this with your own numbers. But basically, you’re going to need to gross up your sales to a point that, based on your gross margin, it will tell you what those sales have to be to get you the dollars that you need to take home at the end of the day to support your family.

Liz Downing (40:12):

We want that number in number three to be 30% or more, right?

Cyndi Thomason (40:17):

Yes. If you’re in column B… Well, for the gross margin, you mean? Step three?

Liz Downing (40:25):

Yeah. We’ve had an attendee asking if you can emphasize one more time on the 30% gross profit margin. That’s your at least-

Cyndi Thomason (40:34):

Yeah, 30 is your goal. I’ve got a few clients that are teetering a little bit below that. It’s a benchmark number. If you’re hitting 30% or more in a product-based business, now it’s a different number for services, but in a product-based business, 30% or more will get you to a place where you should be able to fund all of those other things that you need and continue to keep your inventory flowing.

Liz Downing (41:02):

Awesome.

Cyndi Thomason (41:04):

I think that pretty much we’ve covered everything we’d said we would cover. I am happy to answer any questions and we’ve got a link there for anybody that’s interested in using that owner pay calculator.

Liz Downing (41:23):

We had a question from an attendee that had to leave that I’m actually going to have you reach out because he’d like to have a call with you. But let me copy that into a notepad while I… Hey, everybody, I will send this link out to you. To everyone. So, it’s http dash, webinar for the owner pay calculator. All right, folks, don’t be shy. If you’ve got a question for Cyndi, or you got a question for me, type it into the question section of GoToWebinar. We could actually cover the question from the fellow that left so that it benefits everybody. But first we have Spencer who asked, “In following the profit first model, when I get a disbursement, do I subtract my COGS from that pay period then divide up whatever is remaining into profit, like owner pay taxes, OPEX, that kind of stuff, is that how it works?

Cyndi Thomason (42:33):

Yeah. Typically, when you get your settlement… We’ll just use Amazon as an example. So you get your settlement from Amazon. If you’ve got a long period of data, we like to go back and just do a bigger analysis to understand how the flow actually is working overtime. But a simplified approach, and it’s what I recommend to people that are just getting started, is when you get your payout from Amazon, look at that time period that the payout covers, let’s say the last two weeks, and see what the cost of goods sold were for that last two weeks. And that amount you want to take out and put in your inventory bank account.

Cyndi Thomason (43:17):

Basically, what you’re doing is putting money in an inventory bank account to create a pool of funds to buy your next round of inventory. Some of our clients say, “But I want to grow and I’m just replenishing.” That’s a very good point. So, if you want to take that amount of your cost of goods sold, times 10%, then you can do it that way. Put that aside in your inventory bank account and your inventory bank account will be growing. Then the balance of what’s left, you can apply and move up percentage to profit, a percentage to owner pay and taxes, then your OPEX is always last.

Liz Downing (44:00):

Excellent. The fellow that had to leave said that, so his business sells on Amazon, I think that he’s 1P, so Vendor Central, and he says that the payments to vendors seem arbitrary or at least somewhat unknowable. We never know what they’re paying us for. They sell office furniture; they came from a brick and mortar scenario and they’re branching more into ecommerce. Job costs have cut out their transactions individually, it’s very difficult to do this. His general accounting question is: How do businesses that do thousands of transactions a day have unknowable payment terms? How do they reconcile their accounting? How do they figure out what their profits are without touching each individual transaction?

Cyndi Thomason (45:01):

Okay. Did you say he was on Vendor Central?

Liz Downing (45:05):

I think so. Although a lot of people refer to themselves as vendors and they’re really on Seller Central, but he’s gone now. So, let’s cover it for vendors and sellers, just to be safe.

Cyndi Thomason (45:16):

Well, the vendor side, I’m afraid I’m not the one. We don’t do anything with Vendor Central. So, I don’t know how that works. But on the Seller Central side, we do not think the way to do accounting is to bring every transaction into your accounting system. You have a tool with Amazon Seller Central that’s keeping up with those transactions. Many of our clients also have another tool, some type of inventory system, that’s keeping up with that activity. To try to then make that balance over into an accounting system, first of all, as you grow, the good news is those orders are just going to get bigger and bigger; the bad news is you’re dealing with cloud software and having all of those orders in your accounting system. It’s just going to bog it down. It’s too much for an accounting system.

Cyndi Thomason (46:20):

So, we like to use the tools that you may already be using, like an inventory system. Or we use A2X, a lot of times, as a system to keep up with reconciling those payments from Amazon then that creates a journal entry. Every time you get a settlement from Amazon you get a journal entry that goes into your books. It’s burdensome to an accounting system to have to keep up with that many transactions, that’s one reason not to do it. Another reason is it is redundant and typically what happens is you end up wasting all kinds of accounting resources trying to balance between them. If you don’t believe the system is right and your inventory system doesn’t support it, figure out one of those two systems to trust then let that be the data input that you move over in the summary fashion into your accounting system. Just trying to reconcile it between two systems is not going to help you get any better at that.

Liz Downing (47:27):

We have a question from Spencer. Do you have any bank account recommendations that are good for profit first? So, no extra charges for multiple accounts, no account minimums, connects to QuickBooks. Do you have any recommendations on that?

Cyndi Thomason (47:40):

Yeah, we do. We like Relay Bank and there’s another one out there, Mercury Bank. I don’t deal with Mercury as much but we like Relay Bank a lot. Spencer, if you will email me Cyndi, C-Y-N-D-I@bookskeep.com’, I’ll be glad to send you my link. I don’t get anything from that, but quite honestly they’re not open unless you… They look for… What do I want to say? They’re vetting the people they take into the bank right now because it’s a fairly new product. I’ve been using it probably eight months or more, but they don’t just open it to anyone so they want people to be referred into the bank. If you want to email me, Spencer, I’ll give you my link and that will allow them to know that you’re not a bad actor.

Liz Downing (48:38):

I just blasted out. It’s ‘C-Y-N-D-I@bookskeep.com’, and I just blasted that out to everybody that’s here. So-

Cyndi Thomason (48:46):

Yeah. Anybody that’s interested in that, it’s a really… They are a FinTech type bank, you can open many bank accounts. But they’re built on the back of a bank that’s over 100 years old called Evolve Bank in Tennessee. So, you kind of get best of both worlds with that traditional bank experience, but a nice platform built on the front end of it.

Liz Downing (49:15):

Scott Sharp says, “Great job.” And-

Cyndi Thomason (49:18):

Hi, Scott. Thank you much.

Liz Downing (49:23):

For somebody who’s outgrowing QuickBooks, what is the next step? Like the next high-powered accounting system that they should use. Or is that when it’s time to call you when they’ve graduated from QuickBooks?

Cyndi Thomason (49:35):

Well, no. We use QuickBooks online and we use Xero. Those are the two that, I think, can really adequately serve most of our clients. If you’re getting to the point where you are outgrowing that, it’s typically because you’ve got a lot more complexity than our traditional ecommerce clients have. There’s a product out there called NetSuite that will manage inventory. But you’re looking at that point of probably having dedicated in-house accounting resources and it’s a whole level of complexity beyond what our traditional ecommerce clients use. I will say we’ve got clients that have gone from zero to over 33 million, and because we’re not trying to keep up with every aspect of the business in QuickBooks, it serves fine as a general ledger package. I think most people can operate in QuickBooks or Xero for quite a long time.

Liz Downing (50:46):

So don’t give up on it. Do you have any guidelines for the percentage of revenue that should go to marketing an ecommerce product business? You’ve got, like paying somebody to do your A-plus content if you’re brand-registered, you’ve got advertising, if you’re selling your own ASIN, you’ve got marketing your ecommerce store that supports your Amazon business, all that kind of stuff. What percentage do you normally recommend?

Cyndi Thomason (51:16):

It’s a hard number. I have seen it all over the place. Here’s the thing I think that’s a more important thing to pay attention to. When you invest those dollars, are you seeing the return? What I’ve seen over and over with clients is they work with marketing agencies who send them all these wonderful reports that tell them how effective their marketing dollars are, and they spend a fair amount of money in the marketing bucket. This has happened over and over but this is one client that sticks in my brain, he had been spending for the first half of… Couple of years ago, he’d spent about $250,000 on advertising, and every month we’d send him a note and say, “This is really looking like it’s getting out of hand.” And he’d say, “Oh, no. This is my buddy. He’s been doing this a long time. I’m getting great data from him.” Okay. Finally, about six months into the year, he reaches back out and he says, “I’m never having enough money in my OPEX bucket anymore. What’s going on?”

Cyndi Thomason (52:31):

And I’m like, Okay. You see, this 250,000 that you have peeled out to go into advertising, you would think that would generate… Some of the marketing numbers I see is if you spend, for every dollar you spend you should be able to get $6 back or more, you know? But your revenue has only increased for the year $90,000. So, you’ve 250,000 and your revenue has gone up 90,000. That’s not working for you. So, pay attention to that relationship between the dollars that you’re spending and the revenue that you’re going up. Profit First is all about the bank accounts, as Spencer was talking about. OPEX is one bank account. For clients that are really trying to dial in their marketing account, we will pull out marketing into a separate bank account. Here’s what happens. You’re funding it with a percentage of sales. So if your sales are growing, then your marketing dollar bucket’s going to grow. And if it’s declining, then you’re not going to have as many dollars available for marketing. It’s a really easy way to see the relationship between what you’re spending and what you’re receiving as a benefit from the marketing.

Liz Downing (53:51):

Someone asked, “How does Relay Bank compare to Mercury?” They’ve got an account at Mercury and they’re wondering if they should move.

Cyndi Thomason (53:58):

I think they’re very similar. I’ve got clients in both. I’ve not been in… As an accountant, I have a platform into Relay that makes it very easy for me to go into my clients’ banks. I love that from an accounting standpoint. But I think the actual products themselves from a user’s perspective are very similar.

Liz Downing (54:22):

Okay, cool. Jill asks, “Can you recommend an inventory management software?” And I can.

Cyndi Thomason (54:32):

Okay. Please do, because so far we are not in love with anything.

Liz Downing (54:36):

Yeah. I started my ecommerce journey in this industry with eComEngine, and they’ve got a product called RestockPro that is very comprehensive, especially if you’re doing mostly or all FBA business and you’re not looking for multi-channel inventory solutions, you’re just looking for Amazon business. They’ve just recently launched it in a bunch of different marketplaces. So, if you have a US account and other country accounts, it’s likely that it’ll be supported there. And you can get a 30-day free trial with them. I’ll put this in the chat but it’s ‘ecommengine.com’ and just navigate to the RestockPro area and you can get an overview of it. But it’s a really, really good product.

Cyndi Thomason (55:35):

Yeah. It does really well for the Amazon piece, and we’ve got a number of clients using it for that. For those people that are multi-channel, we’ve had a little bit of difficulty finding something that-

Liz Downing (55:46):

It’s really difficult.

Cyndi Thomason (55:48):

Yeah. And it’s not because there’s no products out there. There are a number of products out there and we dig into them thinking, “Oh, this is going to be the one.” Then we come back and no, it disappoints in some way.

Liz Downing (56:03):

Yeah. That’s a really big gap in the industry, I think, and something that needs to be solved. But it’s difficult enough to reconcile the inventory with Amazon. Then hooking into other APIs and all that jazz, it’s a difficult product to come up with. A lot of people have tried and not quite gotten there. But I have hope.

Cyndi Thomason (56:24):

Yeah, me too.

Liz Downing (56:27):

All right. Great. It looks like the questions have wrapped up. If you guys have any questions at all for Cyndi it’s Cyndi, ‘C-Y-N-D-I@bookskeep.com’. You’ve got questions for me. It’s LDowning, ‘D-O-W-N-I-N-G@teikadev.wpengine.com’, T-E-I-K-A-M-E-T-R-I-C-S. Cyndi, thank you so much. It’s always such a pleasure. For those of you who attended today, this recording will be emailed to you along with the recap. And Cyndi, if you don’t mind, I’m going to share a PDF of the slides.

Cyndi Thomason (57:01):

Absolutely. That’d be great.

Liz Downing (57:02):

Okay, great. So, all of you will get that. Thanks for coming today. We’ll see you at our next webinar. Incidentally, in a few weeks we’re doing a webinar with George from ShipBob, and it’s all going to be about inventory management. So, keep an eye on our webinars page at ‘teikametrics.com’ because he’s going to drop some knowledge bombs on you, like Cyndi did, but it’s going to be about inventory instead of accounting. Happy Tuesday to everybody, go forth, be prosperous and happy selling. Bye.

Cyndi Thomason (57:31):

Thanks for having me Liz.

Liz Downing (57:32):

Thanks Cyndi.